Neuland Labs Ltd - Q3FY21 Result Update

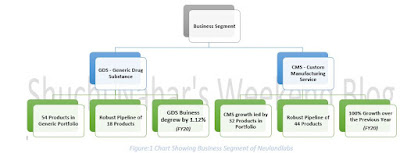

Neuland Labs Ltd Q3FY21 Result Update Twitter Handle: @shuchi_nahar Link to Company Overview of Neuland Labs in detail: https://myweekendspot.blogspot.com/2020/09/neuland-labs-company-snapshot.html The company has announced consecutive another strong quarter of top-line and bottom-line performance. The revenue at Rs.245.6 crores was a 20% improvement over the corresponding quarter of the last fiscal while the margins have shown an upward trajectory and closed at 19.0%. This was driven by growth across the GDS and CMS verticals. The company remains confident of its long-term growth aspirations as well as its margin resilience. • Total income increased by 20.0% in Q3FY21 on account of secular growth in GDS and CMS. • Prime segment continues growth led by Levetiracetam and Mirtazapine. • Speciality business had a stable quarter led by Deferasirox and Dorzolamide. • CMS business witnessed growth in scale-up projects and higher projects coming up for validation. • Two ...