Importance of Behavioral Finance

Blog 3

Shuchi. P. Nahar

Need of behavioral finance in today's market scenario..

As discussed in the previous blog , this blog is in continuation and this will help an individual, industry veteran and beginners to understand the roots of finance , depth of instincts and biases.

Link to previous blog for detail understanding.

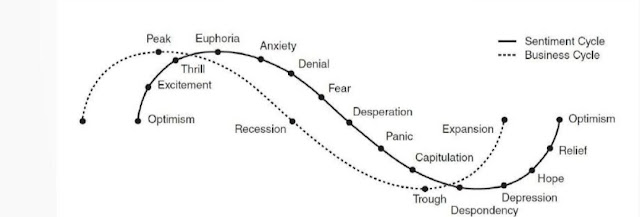

Behavioral finance came about as a way to explain in a rational way the irrational behavior of markets and investors or, as one acclaimed economist put it, finance from a broader social science perspective including psychology and sociology.

Behavioral Finance seeks to account for this behavior, and covers the rationality or otherwise of people making financial investment decisions. Understanding Behavioral Finance helps us to avoid emotion-driven speculation leading to losses, and thus devise an appropriate wealth management strategy.

Unlike a classical financial theory, behavioral finance expects individuals to be more influenced by their emotions or reasonable biases rather than taking the rational approach.

There are few biases ,instincts, fears that an investor suffers throughout his investment journey.

It's important for an investor to know and understand this behavior and rectify it in tough times.

So here are few basic and commonly found instincts, fear or biases that will help an individual , an investor to know their behavior in volatile market situation.

Different types of instinct an investor faces

1] Instinct of Greed

Equity Investors get caught up in greed (excessive desire). After all, most of us have a desire to acquire as much wealth as possible in the shortest amount of time.

2] Instinct of Instant Gratification

Instant (or immediate) gratification is a term that refers to the temptation, and resulting tendency, to forego a future benefit in order to obtain a less rewarding but more immediate benefit.

3] Instinct to Form Groups

Forming a group is a mentality that is distinguished by a lack of individual decision-making or introspection, causing people to think and behave in a similar fashion to those around them.

4] Instinct to Justify

People tend to run from their own mistakes, don’t hesitate to accepting your own mistakes . Accept your mistakes and learn from it.

5] Instinct to do Activity

Stock market investors can’t sit still. Humans have a tendency to do some or other activity and falling prices will tempt investors more to indulge themself in such activity.How Should Equity Investors Escape from their Own Instincts ?

- Make a sell report on your major holding stock.

- Or else ask your peers to do the same.

- Always try to document your beliefs, when you buy any stock write down the reason of buying that stock.

- Have a no laptop workday. (sit back and recollect all the reasons peacefully)

- Self doubt is an equity investors best friend. Doubt everything you finalized. It will keep you on your toes.

- Arrogance and overconfidence are your worst enemy . The market will kick you where it hurts the most ——-The wallet!

Importance of Behavioral Finance in Stock Market

1] Loss Aversion

Loss aversion is a tendency in behavioral finance where equity investors are so fearful of losses that they focus on trying to avoid a loss more, than making gains. The more one experiences losses, the more become prone to loss aversion.

2] Sunk Cost Fallacy

This loss aversion instinct is what leads us into Sunk Cost Fallacy. A Sunk Cost is money or time you have invested in a project or investment already and which cannot be recovered.

3] Decision Bias

Decision bias speaks to the ways we’re prejudiced or unduly influenced (consciously or unconsciously) when making decisions.

4] Endowment Effect

The endowment effect, in behavioral finance, describes a circumstance in which an individual values something that they already own, more than something that they do not yet own.

5] Mental Accounting

Mental accounting contends that individuals classify personal funds differently and therefore are prone to irrational even detrimental decision-making in their spending and investment behavior. This is the tendency of people to designate money for a certain purpose. So, money in a savings jar is treated differently than money meant for debt repayment. People tend to say that money in that savings jar can’t be used for another purpose, even if it means paying down debt at 15% interest.

6] Hindsight Bias

Hindsight bias is a psychological phenomenon in which past events seem to be more prominent than they appeared while they were occurring. Hindsight bias can lead an individual investor to believe that an event was more predictable than it actually was. Hindsight bias is the misconception, after the fact, that one “always knew” that they were right. Someone may also mistakenly assume that they possessed special insight or talent in predicting an outcome.

7] Mental Heuristic

Heuristics are methods for solving problems in a quick way that delivers a result that is sufficient enough to be useful given time constraints. Equity investors and financial professionals use a heuristic approach to speed up analysis and investment decisions.

8] Representative Heuristic

Representatives uses mental shortcuts to make decisions based on past events or traits that are representative of or similar to the current situation.

9] Pattern Recognition

Patterns are the distinctive formations created by the movements of security prices on a chart.

10] Herd Behavior

Following the crowd is something quite common, and it results in some of the most interesting effects. As the larger group does something like buy a “hot” stock, or sell in a panic when the market drops individuals tend to follow suit. Breaking herd mentality is one of the best things you can do for your own finances.

Biases of Value Investor in Stock Market

1] The Absolute Cheapness Bias

Value investors generally try to earn higher returns through stocks which stay at complete cheap valuations.

2] The Under Researched Stock Bias

A big number of value investors, even the best ones, are always keen to enjoy the process of making a diversified equity investment portfolio and are less concerned about the profit part.

3] The Conservatism Bias

Value investors have a licence to be conservative . Lots of them can be also classified as pessimists too! Of course, when a pessimistic guy finds an attractive idea and loads up on it, the results can be fabulous. Value investors tend to be more conservative while reacting towards selection of stocks.

4] The Closed Mind Bias

When value investors have researched a lot about some stocks, they will tend to close their minds and stop reacting to others opinion.

5] The ‘Ignore Macro Stuff’ Bias

A lot of value investors take investing decisions based purely on valuations and not based on macro economics. There should be a fine line to be maintained here as per one’s inclination as well as ability to understand and analyse macro economic data.

6] The Circle of Competence

Identify what you are good at and what you know, identify what you are not good at and what you don’t know and then just stick to the former. But some value investors escape taking efforts by saying that something is ‘out of my circle of competence’. But one should always try to expand their own circle of competence.

Conclusion

So, what can be said is that people are not always rational just like the market is not always efficient. Behavioral finance helps us in understanding why people usually do not make the decisions that they are supposed to, just like why the market acts unreliably at times.

There are several researches which vindicates that a large number of investors make decisions not based on logic but emotion which is usually seen in cases where the investors purchase stocks at higher price based on speculation and then sell off at lower price under panic.

There are other concepts in behavioral finance that help explain irrational human behavior. You can overcome some of these biases, though, by being aware of them, and adjusting your own behavior to reflect more practical and rational behaviors.

Behavioral Finance is an in depth study on these patterns and is creating a crucial place for itself among investors and investment managers.

Hope this article recalls the basic concepts that are very important to each and every individual in their investment journey.

Shuchi.P.Nahar

Comments

Post a Comment