Government Initiatives to boost Growth for Indian Chemical Sector

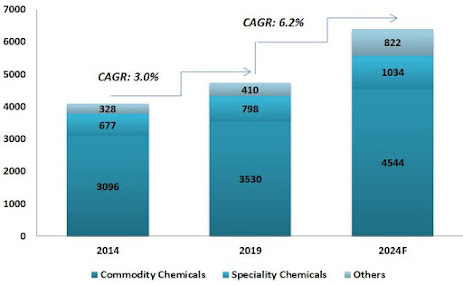

India's Growth Trajectory in Chemical Sector supported by Government Initiatives Twitter Handle: @shuchi_nahar The global chemicals market is valued at around USD 4,738 billion and is expected to grow at 6.2% CAGR reaching USD 6,400 billion by 2024. The Indian chemicals market is valued at USD 166 billion (~4% share in the global chemical industry) and it is expected to reach ~USD 280-300 Bn in the next 5 years, with an anticipated growth of ~12% CAGR. The specialty chemical industry forms ~47% of the domestic chemical market, which is expected to grow at a CAGR of around 11-12% over the same period. Stronger growth lead by Government Initiatives India’s growth story was largely positive based on the strength of domestic absorption and the economy was registering a steady pace of economic growth pre-Covid. Moreover, its other macroeconomic parameters like inflation, fiscal deficit and current account balance had exhibited distinct signs of improvement. Though the pandemic has l...