Laurus Labs - The Stronger Conviction for CDMO's

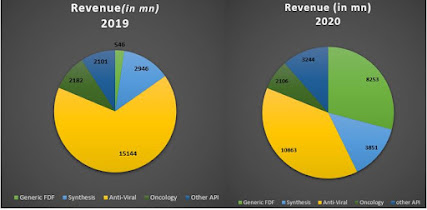

The Stronger Conviction for CDMO's - Bright Future Ahead Twitter Handle: @shuchi_nahar 1) Laurus Labs –The Complete Turnaround Story Laurus Labs is a leading R&D driven pharmaceuticals company established in 2005 with its headquarters in Hyderabad. It is among the leaders in the manufacturing of Active Pharmaceutical Ingredients (APIs) for Antiretroviral (ARV) and Hepatitis C (Hep-C) formulations. Other major API segments include therapeutic areas such as Oncology, Cardiovascular, and Anti-Diabetes. From a one-product company in 2010 to an Active Pharmaceutical Ingredients (APIs) company thereafter, the company has now emerged as one of India’s leading manufacturers of generics APIs for various complex therapies. Revenue Comparison FY19 v/s FY20 Significant Growth in CDMO For Detailed Analysis of the above company - https://myweekendspot.blogspot.com/2020/09/laurus-labs-company-overview.html To continue reading this great compilation of CDMO Companies Click the Link : https://...