Recent Disruption in China, beneficial for Indian Chemical Companies

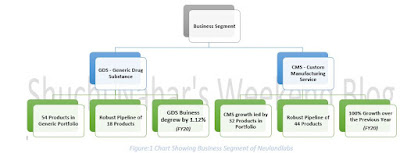

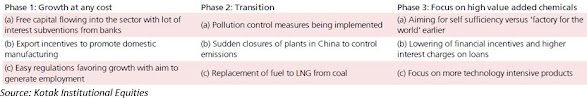

Recent disruption in China - Impact on Indian Chemical Companies Twitter Handle: @shuchi_nahar Specialty Chemical Article: https://myweekendspot.blogspot.com/2021/07/speciality-chemicals-market-size-demand.html Government scheme to boost: https://myweekendspot.blogspot.com/2021/07/government-initiatives-to-boost-growth.html Indian specialty chemicals companies are poised to ride tailwinds from macro drivers including ‘China+1’, import-substitution, growing costs within China (capital, operational, compliances), and currency benefits. Recent disruptions in China will cause medium-term challenges for downstream producers while benefiting base chemical suppliers. More importantly, these frequent supply disruptions in China further strengthen the case for quality Indian players in the chemical domain. Growing import substitution by local industry makes a case for strengthening volume growth for base chemical/intermediate suppliers. Recent disruptions in China (electricity s...