How Credit Card helps generating profits ?

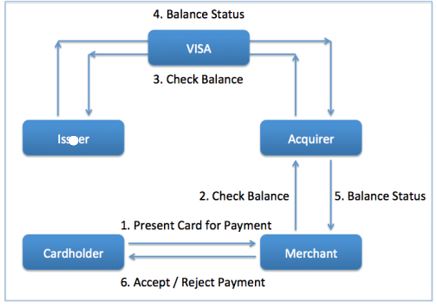

How Banks make Money through Credit Cards? SHUCHI.P.NAHAR To understand how credit cards works, which customer segments it serves, what it offers to its customer segments, and how does it makes money from them, we need to get familiar with few terms. Credit cards classifies the banks as either Issuers or Acquirers. Issuers issue cards to the cardholders, whereas the Acquirers manage the relationship with the merchants. The diagram below explains what happens behind-the-scenes when a cardholder presents a card for payment to a merchant. What types of risk bank accepts? Bank usually accepts three types of risk 1) Credit 2)Liquidity 3)Interest rate and they get paid to take on the risk. Managing credit risk Credit risk is the core part of the lending business . investors can get a sense of a banks credit quality by examining its balance sheet , loan categories , trends in non performing loans and charge off rates as well as managements lending philosophy.