How the Economic Mechanism Works ?

How the Economic Machine Works ? - Ray Dalio

Shuchi.P.Nahar

How the Economic Machine Works: “A Transactions-Based Approach”

A sum of transaction is what builds the economy. Transactions are in human nature that creates three main forces that drive the economy.

1. Productivity

2. Short Term Debt Cycles

3. Long Term Debt Cycles

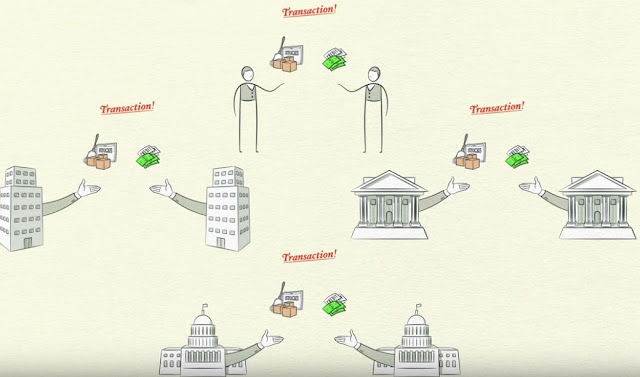

An economy is simply the sum of the transactions that make it up. A transaction is a simple thing. Because there are a lot of them, the economy looks more complex than it really is. If instead of looking at it from the top down, we look at it from the transaction up, it is much easier to understand. A transaction consists of the buyer giving money (or credit) to a seller and the seller giving a good, a service or a financial asset to the buyer in exchange.

A market consists of all the buyers and sellers making exchanges for the same things – e.g., the wheat market consists of different people making different transactions for different reasons over time. An economy consists of all of the transactions in all of its markets. So, while seemingly complex, an economy is really just a zillion simple things working together, which makes it look more complex than it really is. For any market, or for any economy, if you know the total amount of money (or credit) spent and the total quantity sold, you know everything you need to know to understand it.

For example, since the price of any good, service or financial asset equals the total amount spent by buyers (total $) divided by the total quantity sold by sellers (total Quantity), in order to understand or forecast the price of anything you just need to forecast total $ and total Quantity. While in any market there are lots of buyers and sellers, and these buyers and sellers have different motivations, the motivations of the most important buyers are usually pretty understandable and adding them up to understand the economy isn’t all that tough if one builds from the transactions up. This perspective of supply and demand is different from the traditional perspective in which both supply and demand are measured in quantity and the price relationship between them is described in terms of elasticity. This difference has important implications for understanding markets.

Productivity

Productivity matters the most in long term and not short

term unlike debt , thus change in cycle is not due to much creativity or

innovation there is but due to credit being availed. When there is excess money in market the central bank lifts

the interest rate to control inflation phase

- deflation phase.This cycle continues for 5-8 years , but each time it occurs

it ends up with more growth and debt.

Productivity matters most over the long run but credit

matters most in the short run. Productivity growth tends to be linear. As we

age, we become more productive. And as the economy as a whole ages, it becomes

more productive too. It's the use of credit that leads to economic cycles. Debt

allows us to consume more than we produce when we acquire it, but forces us to

consume less than we produce when we pay it back. When we use credit, we're

borrowing from our future selves.

Short Term Volatility

Short-term volatility is more due to debt cycles than productivity, but this volatility cancels out over time because credit allows people to consume more than they produce when they acquire it, and it forces people to consume less than they produce when they pay it back. Undulations around long-term productivity are driven by debt cycles.Remember, in an economy without credit, the only way to increase your spending is to produce more, but in an economy with credit, you can also increase your spending by borrowing. That creates cycles. When debt levels are low relative to income levels and are rising, the upward cycle is self-reinforcing on the upside because rising spending generates rising incomes and rising net worth, which raise borrowers’ capacity to borrow, which allows more buying and spending, etc.

However, since debts can’t rise faster than money and income forever, there are limits to debt growth. Think of debt growth that is faster than income growth as being like air in a scuba bottle there is a limited amount of it that you can use to get an extra boost, but you can’t live on it forever. In the case of debt, you can take it out before you put it in (i.e., if you don’t have any debt, you can take it out), but you are expected to return what you took out. When you are taking it out, you can spend more than is sustainable, which will give you the appearance of being prosperous. At such times, you and those who are lending to you might mistake you as being creditworthy and not pay enough attention to what paying back will look like. When debts can no longer be raised relative to incomes and the time for paying back comes, the process works in reverse.

The concepts of how productivity and indebtedness affect growth, then fleshed these forces out with specific indicators, and then saw how the formula created this way worked. This approach because its believe that one should be able to describe the cause-effect relationships and the logic behind them without looking at the data and that only after doing that should one look at the data to see how well the descriptions square with what happened because otherwise one would be inclined to be blinded by data and not force oneself to objectively test one’s understanding of the cause-effect relationships. As mentioned, from what I can tell, about two-thirds of a country’s 10-year growth rates will be due to productivity and about one-third will be due to indebtedness. The visual below conveys these two forces. Our productivity indicators aim to measure how steep the productivity growth line will be over time, and our indebtedness measures aim to measure how debt cycles will influence growth over the medium term.

How the Market-Based System Works As mentioned, the previously outlined economic players buy and sell both:

1) goods and services 2) financial assets, and they can pay for them with either 1) money or 2) credit. In a market-based system, this exchange takes place through free choice i.e., there are “free markets” in which buyers and sellers of goods, services and financial assets make their transactions in pursuit of their own interests.

The production and purchases of financial assets (i.e., lending and investing) is called “capital formation”. It occurs because both the buyer and seller of these financial assets believe that the transaction is good for them. Those with money and credit provide it to recipients in exchange for the recipients’ “promises” to pay them more. So, for this process to work well, there must be large numbers of capable providers of capital (i.e., investors/lenders) who choose to give money and credit to large numbers of capable recipients of capital (borrowers and sellers of equity) in exchange for the recipients’ believable claims that they will return amounts of money and credit that are worth more than they were given. While the amount of money in existence is controlled by central banks, the amount of credit in existence can be created out of thin air i.e., any two willing parties can agree to do a transaction on credit – though this is influenced by central bank policies.

In bubbles more credit is created than can be later paid back, which creates busts. When capital contractions occur, economic contractions also occur, i.e., there is not enough money and/or credit spent on goods, services and financial assets. These contractions typically occur for two reasons, which are most commonly known as recessions (which are contractions within a short-term debt cycle) and depressions (which are contractions within deleveraging).

Recessions are typically well understood because they happen often and most of us have experienced them, whereas depressions and deleveraging are typically poorly understood because they happen infrequently and are not widely experienced. A short-term debt cycle, (which is commonly called the business cycle), arises from a) the rate of growth in spending (i.e., total $ funded by the rates of growth in money and credit) being faster than the rate of growth in the capacity to produce (i.e., total Q) leading to price (P) increases until b) the rate of growth in spending is curtailed by tight money and credit, at which time a recession occurs. In other words, a recession is an economic contraction that is due to a contraction in private sector debt growth arising from tight central bank policy (usually to fight inflation), which ends when the central bank eases.

Recessions end when central banks lower interest rates to stimulate demand for goods and services and the credit growth that finances these purchases, because lower interest rates 1) reduce debt service costs; 2) lower monthly payments of items bought on credit, which stimulates the demand for them; and 3) raise the prices of income-producing assets like stocks, bonds and real estate through the present value effect of discounting their expected cash flows at the lower interest rates, producing a “wealth effect” on spending.

Long Term Debt Cycles

A long-term debt cycle, arises from debts rising faster than both incomes and money until this can’t continue because debt service costs become excessive, typically because interest rates can’t be reduced any more. A deleveraging is the process of reducing debt burdens (i.e., debt and debt service relative to incomes).Deleveraging typically is mix of

1) Debt reduction

2) Austerity

3) Redistribution of wealth

4) Debt monetization.

A depression is the economic contraction phase of a deleveraging. It occurs because the contraction in private sector debt cannot be rectified by the central bank lowering the cost of money. In depressions, a) a large number of debtors have obligations to deliver more money than they have to meet their obligations, and b) monetary policy is ineffective in reducing debt service costs and stimulating credit growth. Typically, monetary policy is ineffective in stimulating credit growth either because interest rates can’t be lowered (because interest rates are near 0%) to the point of favorably influencing the economics of spending and capital formation (this produces deflationary deleveraging), or because money growth goes into the purchase of inflation-hedge assets rather than into credit growth, which produces inflationary deleveraging.

Depressions are typically ended by central banks printing money to monetize debt in amounts that offset the deflationary depression effects of debt reductions and austerity. To be clear, while depressions are the contraction phase of a deleveraging, deleveraging (e.g., reducing debt burdens) can occur without depressions if they are well managed. (See ”An In-Depth Look at Deleveraging.“) Differences in how governments behave in recessions and deleveraging are good clues that signal which one is happening.

For example, in deleveraging, central banks typically ”print“ money that they use to buy large quantities of financial assets in order to compensate for the decline in private sector credit, while these actions are unheard of in recessions.4 Also, in deleveraging, central governments typically spend much, much more to make up for the fall in private sector spending.

But let‘s not get ahead of ourselves. Since these two types of contractions are just parts of two different types of cycles that are explained more completely in this Template, let’s look at the Template.

My Key Learning from Ray Dalio's Presentation:

Why each cycle keep getting intense ?

They have inclination to borrow more, leading to debt rising

faster than income.

Again there is a cycle that ensure more biding and demand

for goods that keeps raising the price- keeping the debt and income equation

still settled.

But if this continues people have to cut back on spending

due to high debt repayment , thus the inevitable chain or spending and earnings

continue reaching a long term debt peak.

Now comes deleveraging of an economy

In a deleveraging people cut spending, credit givers

disappear , asset prices drop,social tensions rise , leaving no one

creditworthy. The borrowers can no more take money to repay their previous

loans , they rush to sell assets results in lower prices -lower stock market. This

looks like deflation, but the difference here is the interest cannot be fiddled

with because interest rates are already

0%(USA-1930’s & 2008) and lenders realized that the money they gave would

never come back since the borrowers have lost ability to pay and their

collateral has lost value. Thus like an individual, the economy itself is not

creditworthy.

Because one man’s spending is cut and so other man’s income

, the income fall faster than debt being repaid This leads us to the next step i.e borrowing

is being reduced , but the bank has

given loans to people who would not be able recover, thus people rush to

withdraw , bank thus squeezes and default on their debt. This is now become a

DEPRESSION - realization when people

thought much of their wealth they had was a not real . this means that what the

bank considered their asset (our collateral ) is not worth anything , thus many

bank settle for debt restructuring, but is still a problem since the assets

have no value- no income.

The central government is impacted by lower tax collection and

give allowance for high unemployment and some goods and services. They spend

more then they earn- this is what you hear ‘fiscal deficit’.

Govt runs out of budget and turns toward taxpayers(failed)

and lenders, but who would it lend from? ‘The richies’. Social disorder and

revolt breaks out - within the country or between two different country,

leading to political change that can be extreme(hitler coming to power).

Quantitative Easing - the central bank prints money and buy

bonds of central government.

People will now assume that the inflation will step in if

there is Quantitative Easing , but not really if its only debt repayment. The equation to

remember is that spending(cash+credit)/quantity is what sets the price - so the

credit disappears and the money printed replaces it. To control this the income

growth needs to be quicker then that of the interest rate.

Deleveraging need not be a very dark phase if its controlled

, if balanced then starts the re-leveraging in the economy.

Takeaways:

Don't let debt be more than income

Don't let income rise than productivity

Increase your productivity.

Shuchi.P. Nahar

Sources: Ray Dalio's Presentation https://www.youtube.com/watch?v=PHe0bXAIuk0&t=536s

Comments

Post a Comment