How Credit Card helps generating profits ?

How Banks make Money through Credit Cards?

SHUCHI.P.NAHAR

To understand how credit

cards works, which customer segments it serves, what it offers to its customer

segments, and how does it makes money from them, we need to get familiar with

few terms. Credit cards classifies the banks as either Issuers or Acquirers.

Issuers issue cards to the cardholders, whereas the Acquirers manage the

relationship with the merchants.

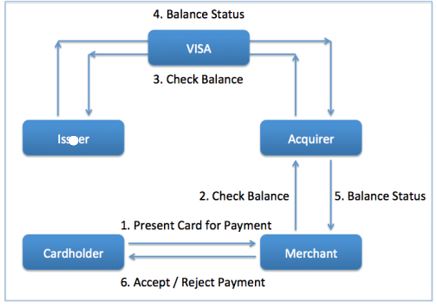

The diagram below explains

what happens behind-the-scenes when a cardholder presents a card for payment to

a merchant.

What types of risk bank

accepts?

Bank usually accepts three

types of risk

1) Credit

2)Liquidity

3)Interest rate and they get paid to take on the risk.

1) Credit

2)Liquidity

3)Interest rate and they get paid to take on the risk.

Managing credit risk

Credit risk is the core

part of the lending business . investors can get a sense of a banks credit

quality by examining its balance sheet , loan categories , trends in non

performing loans and charge off rates as well as managements lending philosophy.

When a cardholder presents

a card for payment to a merchant, the payment request is forwarded to the

acquirer. The acquirer contacts the issuer through the VISA network. The issuer

shares the information on whether sufficient balance is available to carry out

the transaction.

The information is then routed to the merchant. In case sufficient balance is available, the payment is accepted. Else, it is rejected. The issuer bills the cardholder on a monthly basis. The cardholder pays those bills then.

The information is then routed to the merchant. In case sufficient balance is available, the payment is accepted. Else, it is rejected. The issuer bills the cardholder on a monthly basis. The cardholder pays those bills then.

What is ignored in the diagram the reality is explained below!

What the above diagram does not tell

is how VISA and banks make money in the process. They make money from the

transaction fees charged to merchants. To understand how it works, imagine a

$100 payment from a cardholder to merchant.

In case the merchant fee is 2.4%, the merchant would get $97.60 from the transaction. $2.40 would get unevenly split between issuer and acquirer, depending upon the interchange fee. In case of an interchange rate of 1.8%, the issuer will keep $1.80 and acquirer will keep $0.60.

Issuer gets to keep more of the merchant fee because of a higher risk of payment default from the cardholder.

In case the merchant fee is 2.4%, the merchant would get $97.60 from the transaction. $2.40 would get unevenly split between issuer and acquirer, depending upon the interchange fee. In case of an interchange rate of 1.8%, the issuer will keep $1.80 and acquirer will keep $0.60.

Issuer gets to keep more of the merchant fee because of a higher risk of payment default from the cardholder.

VISA makes money on payment volumes,

transaction processing, and value-added services.

How individual makes money out of this process is explained below:

VISA creates value for all

its stakeholders during the process. Cardholders’ benefit because of convenience,

security, and rewards associated with card payments.

Merchants benefit from

improved sales by offering payment method options to the customers. Banks get

new revenue streams through card fees, late payment interests, and transaction

fee cuts.

Chart explaining the business model for banking companies

Chart explaining the business model for banking companies

Income from Credit Card Interest and Merchant Fees

The primary way that banks make money is interest from credit

card accounts. When a cardholder fails to repay their entire balance in a given

month, interest fees are charged to the account. For any given account, the

interest charged is equal to the card's periodic rate multiplied by the average

daily balance and number of days in a billing period. The periodic rate is the

annual percentage rate (APR) divided by 365. In the United States, the average

credit card interest rate paid by interest-bearing accounts is 14.87%.

The second largest source of income for credit card companies

are fees collected from merchants. When a retailer accepts a credit card

payment, a percentage of the sale goes to the card's issuing bank. This is

commonly referred to as the interchange rate. In the US, the average

interchange rate is around 1.75%, though it varies from card to card and

retailer to retailer.

Credit card companies make money by collecting fees. Out of the

various fees, interest charges are the primary source of revenue. When credit

card users fail to pay off their bill at the end of the month, the bank is

allowed to charge interest on the borrowed amount. Other fees, such as annual fees

and late fees, also contribute, though to a lesser extent. Another major source

of income for credit card companies are fees collected from merchants who

accept card payments. These average out to approximately 1.75% of each

transaction. Through the fees they get to collect, banks make a profit on their

credit card business—approximately 4.04% of quarterly assets.

How Credit Card Companies Make Money or Earn Profit

1. Marketing Tie-ups

You know who is making money these days? Anyone who helps

brand/companies extend their reach. With each passing day, it is difficult to

generate business. You may check the financial results of the company. For

example, brands are spending more on digital marketing because of its reach.

The credit card companies have direct access to their customer base and can

influence their spending. Therefore, credit card companies can help in both i.e

brand promotion and to generate sales. It is very effective and potent tool to

reach new customers. In other words, the objective is to increase sale. These

tie-ups are in the form of freebies, cashback offers, EMI offers etc. Knowingly

or unknowingly customer end up spending more on the credit cards. As per RBI

data, HDFC Bank has issued 62.8L credit cards followed by ICICI Bank at 35L

credit cards. SBI, Citibank, and Axis Bank are at no 3, 4 and 5 respectively.

2. Interest on Balance Outstanding

It’s a universal fact that interest rate on a credit card is

highest among all forms of credit facilities even higher than private lending.

It can be as high as 42% (annually) or 3.5% (monthly). According to industry

estimates, more than 50% of the credit card balance outstanding is not paid on

time. These customers are GOD for credit card companies. Let me clarify that it

is not necessary that 50% credit card balance outstanding means 50% customers are defaulting/delaying the payment.

The

amount should be considered in absolute terms only. I don’t want to make this

post data heavy. Assuming everything remains equal. In this case, credit card

companies are receiving half the payment (absolute) on time and there is a delay

in balance half payment. Therefore for delayed payment credit card companies

are charging 42% interest rate.

To simplify, we can safely assume that credit

card companies are earning interest of 21% of the total outstanding balance. In

other words, the amount spent on a credit card by the customers is fetching an

interest of 21% to banks. From which line of credit, the bank can generate

interest income of 21%. Even if you adjust settlements and written off amount,

my guess is that net interest income should be 18% or more.

3. Cash Advance Charges

The credit card users are aware that they can withdraw cash

against credit card limit. Normally cash limit is 40% of credit limit. This

cash limit can come handy in case of any emergency cash requirement as a short

term loan.

For example, if my credit limit is Rs 5L then i can withdraw a cash

of Rs 2L from my credit card account. I have to bear transaction fees of 2.5%

(Min Rs 300). Therefore, if i withdraw 2L then i will be charged transaction

fees of Rs 5,000. Besides transaction charges, the bank also charges an

interest rate of up to 42% (annually) i.e. 3.5% p.m. from the date of

withdrawal until the date of full payment.

This is one of the costliest loan

option and a most profitable option for the bank to lend during an emergency to

the customer.

4. Annual and Renewal Fees

This is normally paid by the customers whose credit card spend

is low. In other words, credit card companies charge annual/renewal fees in

case customer is using credit card below the threshold limit set by the bank.

It helps to recover the cost of providing the service to low usage customers.

5. Miscellaneous Charges

Besides this, credit card companies

also charge some miscellaneous charges like

(a) Late Payment Charges

(b) Charges on over limit. Normally 2.5%.

(c) Payment return charges

(d) Reward redemption fee

(e) Cash processing fee

(f) Reissue of card.

(a) Late Payment Charges

(b) Charges on over limit. Normally 2.5%.

(c) Payment return charges

(d) Reward redemption fee

(e) Cash processing fee

(f) Reissue of card.

Sources: Nerdwallet.com

Valuepenguin.com

Nitinbhatia's Report

Investopedia

Comments

Post a Comment