Practitioners Insights: Field Guide To Investing

That means no one would have ever thought that 2020 will bring all the unexpected to us. These are the times that were nightmares but anyhow the world is surviving. Staying without work, without income, far from families , pandemic, fire and so on but as its said every coin has two sides lets not forget the good ones.

- Never has the world been so connected.

- Never has the world come to halt.

- Never has there been such levels of debt.

- Never have the basic laws of economics/finance been broken.

- Never has there been such a response from the government.

- Never has there been such disruption for business.

- Learning from history is limited.

- There is no playbook for this.

- Need to revisit everything.

- Reactive, not predictive

- Just write down what you understand.

- Maintain your decision journal.

- Understand your basics, and then search sectors accordingly

- Sectors, where people gather, are there to go for a toss.

- Having a habit of the journal will not waste your time but lead you to invest your money efficiently.

- Understand your basics, and then search sectors accordingly.

- Sectors, where people gather, are there to go for a toss.

- Those that will hurt:- Travel, NBFC, Malls, Theaters.

- Continue as usual like cement, FMCG, auto, agriculture.

- Those will benefit:- Pharma, Chemical,IT.

- Start writing things down, don't justify yourself.

- If you are invested already, stay optimistic.

- Think of existing positions as cash to be deployed anew.

- Don't wait for the right price to come and then you sell it , buying at right price matter most rather than selling.

- If you have cash at this point in time, deploy sensibly.

- There is no one cash-call-fits-all. Comfort & understanding matters.

- Staying on 20% cash, considering the extreme uncertainty is healthy allocation, we don't have to be fully invested when markets are down and have nothing for the time for uncertainty

- Don’t deploy everything and keep something for uncertainty.

- The market gives you either certainty or valuation, never both!

- There can be chances where you don’t find any good investment, but you won’t get both together.

- Valuation and numbers are the cornerstones.

- Invest carefully.

- It’s time to focus.

- Focus - Don’t jump all over the place.

- Everything is falling. That doesn't mean we have to own everything that has bottom rocked , step when you understand , not when others make you understand.

- Don’t jump on things that are new to your understanding

- If you jump to something. That is new to you , you wont understand them though they have fallen you’ll lose time opportunity that you wasted on something new rather than in investing in something that you already had an expertise in. Focus on that industry which you have already have a foot in , jumping to market noises will either make you deaf or a great fall.

- Just because we are analysts doesn’t mean we have to sit and analyze on every other next thing we see, we don't have to be jack of all and master of none. We are good at analyzing companies let's stick to that!

- Your portfolio will not consist of the best stock (in hindsight) except that.

- Don’t start something new right now, Thinking just for short-term gains.

- Complex Companies - like multiple Joint ventures ,Subsidiary, multiple business ,multiple products.

- You won’t understand every subsidiary.

- Do not get into any flavor of the month: Like Pharma. Chemical

- They are trading on high valuation.

- Re-evaluate every holding.

- If you have researched and Price is falling , it should not really bother you. If its good business - Don't panic (Hold stocks,with deeper conviction.)

- No Balance sheet risk (nature, number).

- Low complexity business.

- A large part of the business is India Centric.

- No promoter/management risk.

- No history of default. Not interconnected with each other.

- When you cannot reach a business completely - avoid that

- Business having moat, but not attractive from a valuation.

- Good Dividend, Earnings, Cash Flow, Asset value. We should have a good command over these. Look at some valuation parameters. Not overall parameters.

- Small/micro caps.

- Now they are available at super valuation.

- Don’t close eyes to small caps.

- If you are uncomfortable in investing in small caps / make a smaller position don’t avoid them completely.

- We can never predict the bottom.

- Just buying at your level is important, buying at the right price matters

- From the fundamental price - we can predict some sense of price, but technical will help decide the selling price more efficiently.

- A business that will revive in the short term.

- Businesses that are serving the old economy.

- Some businesses don't get affected by global economics.

- Simpler the business, simpler to understand.

- Cash - Not finding something according to your understanding, its fine to sit on cash.

- When valuation makes sense - That this the time to Invest.

- Estimate your fair value of the business. The buying price is the most important factor. If something that doesn’t come on your estimated buying price wait till it comes.

- Volatility in the markets.

- Value enough is not okay. he value should be driven with change. Why it would get expensive, should be the first thing to pop up?

- Price is reducing - but what is changing. Only if it is getting cheaper is not sufficient

- Is Something significant happened and that is giving opportunity for business to grow ?

- Is it India Centric business?

- Things are very dynamic.

- When you purchase something with a targeted price for 9-12 months.

- If you get the price 60-70% from your targeted price.

- In a bull market, the mind will tell you to wait but in bear market it will help you to decide whether to sell or hold.

- The logical extension - decision journal.

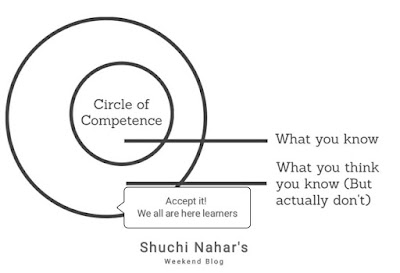

- Knowing what you know is very important.

- But knowing what you don’t know is more important.

- Defining COC is most important. Do it on paper.

- Marrying this concept with a checklist and decision journal helps.

- Define a circle of incompetence also.

- Look for COC in companies you analyse too.

- Always remember, there is no compulsion to invest . MOVE ON!!!

- Do not avoid COC because of your laziness.

- Pick up an industry you find interesting. Preferably something you can relate to.

- Pick up the best performer in the industry and the worst.

- Download all material related to both (AR’s, concalls, corporate PPTs,industry reports, broker reports, media etc.)

- Pen down value drivers of the business, visit industry people talks!

- Revise and Repeat.

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links , references and compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Twitter: shuchi_nahar

Comments

Post a Comment