A Masterclass on Global Custom Development & Manufacturing Opportunity

A Masterclass on Global Custom Development & Manufacturing Opportunity

Shuchi.P.Nahar

To understand what are CDMO,CRAMS,API etc or what will drive pharma sector growth ?Do read my previous articles for brief understanding....

Link: https://myweekendspot.blogspot.com/2020/05/which-segment-of-pharmaceutical-company.html

https://myweekendspot.blogspot.com/2020/05/understanding-pharma-growth-from.html

https://myweekendspot.blogspot.com/2020/05/what-will-drive-pharma-sector-growth.html

https://myweekendspot.blogspot.com/2020/03/pharmaceutical-industry-10-years-future.html

https://myweekendspot.blogspot.com/2020/01/good-fortune-for-pharma-sector.html

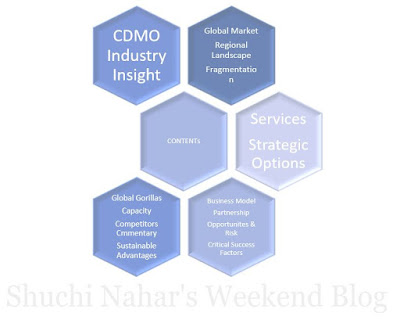

CDMO

Industry Insight

The

global pharmaceutical contract manufacturing & contract research market

size was valued at over USD 123.1 billion in 2016. Cost saving and time saving

benefits associated with the implementation of outsourcing is responsible for

driving the industrial growth.

Companies

are investing in infrastructure, personnel, and technology in order to gain

significant share of the outsourcing revenue. Increasing demand as a

consequence of ongoing patent cliff of the biologic drugs is expected to fuel

demand.

Presence

of end-to-end service providers that are engaged in providing value added

services for an integrated or risk sharing business model is expected to

bolster progress in this industry. Moreover, new product launches and novel

drug delivery mechanisms are anticipated to drive outsourcing demand.

The industry has been alternating between the

cycles of inadequate and excessive production capacity for contract as well as

captive manufacturers. Hence, it is important for Contract Manufacturing

Organizations (CMOs) to make cautious decisions pertaining to capacity

expansion and choice of deals.

CDMO

Global Market

The

CDMO market is estimated to grow to $157.7 billion in 2025, a compound annual

growth rate (CAGR) of 6.9% since 2018, outpacing the pharmaceutical industry as

a whole.

Even

for the biggest pharma companies, CDMOs have graduated from supply

chain to more ratified value chain partners – no

minor attitudinal adjustment.

Fierce

competition, cost pressure, constant technological innovations and increasing

consolidation activities raise the question of which steps [CDMOs] can take to

secure or expand their position in this contested market.

“Should

they focus on their core business or broaden their range of services? Should

they follow the market trend and consolidate or try to grow organically?”

Which

of these options would most benefit Outsourced Pharma readers?

- CDMO is in a growth phase.

- Additional manufacturing capacity

- Avoiding redundant manufacturing capacity(Capex avoidance before commercial launch)

- Opex reduction/avoidance is another driver

- Mitigate the risk of supply shortage

- Reduce time to market ( If internal capacities are limited)

- Favorable macros (increasing population, insurance coverage,ageing societies,rare disease)

- Small and virtual biotech need manufacturing infrastructure

Widespread

Growth

Here’s

a look at that estimated 6.9% CAGR growth by service sector.

You can see consistent growth across the board. Next here’s a look at where it’s taking place.

- Asia Pacific region is leading

- China,India are top in API/CDMO

- US/EU have advanced ecosystem

- Asia has lower Capex and Opex relative to US/EU

This

can generally characterize by great fragmentation despite the strong merger and

acquisition activities in recent years. And it’s not only CDMOs acquiring their

competitors.

“Large

life sciences companies and private equity firms were responsible for some of

the largest deals in the sector (e.g., in 2017, Thermo Fisher Scientific paid

18.2 times Patheon’s earnings before interest, taxes, depreciation and

amortization (EBITDA) to acquire the leading CDMO.”

Nonetheless,

the precipice of 2020, the CDMO market remained “highly fragmented, with more

than 75% of participants having revenues below $50 million, and the five

leading CDMOs holding only 15% of the total market share.”

Which

can only mean one thing: More changes are coming to a CDMO near you.

CDMO Business Model

The

segmentation of the pharmaceutical CDMO value chain follows three major

categories:

- Drug And Process Development,

- Active Pharmaceutical Ingredient (Api) Production And

- Finished Dosage Form (FdF).

Close

to these CDMO core segments are drug discovery and development support,

provided by contract research organizations (CROs) as well as contract

packaging services, which are provided by CDMOs or specialized contract

packaging organizations (CPOs).

Tasks outsourced to CDMOs by pharmaceutical companies cover the entire value chain of a drug’s life cycle, from drug development and preclinical and clinical trials to commercial production. While traditional CMO services were cantered on their core competencies in API bulk manufacturing and formulation, CDMOs have also moved into adjacent segments along the manufacturing value chain.

- Speciality CDMO have a domain technology focus.

- Capacity consolidators prefer inorganic growth

- Vertical Integratators offer a broad range of services from lab to commercial scale manufacturing

These tasks, which in the past have been covered by pharmaceutical companies themselves or by contract research organizations, include medical chemistry, support for preclinical in vitro and in vivo studies, and formulation and process analytics development.

CDMO

Fragmentation

Source: IIC Presentation

As CDMO

industry is relatively immature and fragmented there lies more growth

opportunity.

Majority

players are very small. There is absence of overall market leadership. CDMO is

a contract related service business which is sticky with long term customer

relations. Many smaller CDMOs are either private entities or part of PE

portfolios.

Here

are the key pointers that proves the industry as fragmented.

- Highly regulated industry

- High barriers to entry

- High switching cost

- Highly competitive industry

- Majority are privately held

- Challenging for small companies to

sustain.

Facing Growth Imperatives

With some

exceptions, today Big Pharma tends to want fewer, more integrated partners, and

so that is a path to survival for many CDMOs.

The branches in the decision-making tree for those CDMOs are:

vertical or horizontal integration, and acquisition or organic growth.

Vertical Integration

CDMOs

can strengthen core areas and establish themselves by extending their service

portfolio. In general, this kind of expansion “is less costly

and involves lower initial risks than horizontal integration, because the CDMO

can build on existing knowledge. It also fulfils most regulatory requirements

and enables cross-selling to existing customers.”

With

25% of APIs under development highly potent and trending up, offering HP

services is a logical step for many CDMOs, although building HP facilities can

be a costly investment.

The

study also predicts the pharmaceutical-packaging outsourcing market will grow

at 7.3%, due to new and more rigorous packaging and handling requirements. New

technologies – think “smart packaging – allow for improved functionality and

help a CDMO stand out from the competition.

- Vertical integration generally seen more straightforward

- Customer gets to consolidate sourcing

Horizontal

Integration

CDMOs

that want to diversify their risk or position themselves as fully integrated

service providers can start offering services for other dosage forms, expanding

into a new dosage form tends to be an expensive and risky endeavour. Barriers

to entry include high upfront costs, lack of expertise and reputation, and

finding qualified employees.

Interestingly,

the sterile liquids are the fastest-growing dosage form in the CDMO

market. Profit margins are highest in this segment, making it an attractive

dosage form for new market entrants.

Solid

dosage forms are becoming less attractive (compared to liquid forms), but

“remain a profitable and growing segment,” as this remains the most common

dosage form for newly approved drugs.

“Considerations about whether organic growth

or acquisition is the more suitable method of expansion should be factored in right from the beginning, as they are

closely intertwined with the feasibility of different strategic options [facing

CDMOs].”

Acquisitions

allow CDMOs to expand relatively quickly. They add new technologies to

portfolios and access to new customers, again opening opportunities for cross

selling. Some CDMOs are also looking to gain a more global footprint through a

merger.

The

caveat: Only ~50% of mergers across all industries succeed, “and the choice of acquisition or organic growth is strongly linked to

the financial means of the CDMO.”

CDMO Opportunities and Risk

Opportunities

- Increasing pharmaceutical specialty chemicals research, developments and manufacturing outsourcing (Capex, opex avoidance , risk mitigation)

- Increasing number of virtual,small biotech and small to mid pharma with inadequate development,scale up infrastructure

- Technological advancement

- New operational techniques

- Help big pharma transform fixed costs to variable

- Faster research at lower cost

- Zero tolerance culture for clients IP protection

- Breach of data protection (Regulatory Compliance)

- Ever evolving and fragmented regulatory environment

- Competitive marketplace unless CDMO has some unique advantage

- High dependence on skilled labour

- Supply chain disruptions

- Customer concentration

- Innovator pausing or suspending development

- Termination of relationship

Conclusion

CDMOs that want to succeed need to consider their reaction to current trend and evaluate their strategic options.Capabilities company size, ownership, risk preference, organizational culture and available capital are just some of the factors that must be taken into account.

CDMOs face excellent growth opportunities in a pharmaceutical market environment where using outsourcing service is becoming new norm.

Critical Success Factors

- Respect for innovator's intellectual property

- Immaculate regulatory compliance track record

- Superior technology investments

- Agility and supply chain reliability

- R&D,documentation,data integrity and manufacturing excellence

- Client Centric mindset

- Adequate human capital investments(Skill & Capacity)

- Adequate research,development and manufacturing infrastructure

This unique blog is definitely educating as well as diverting. I have chosen many interesting stuff out of this blog.

ReplyDeleteThat's really awesome blog because i found there lot of valuable Information and i am very glad that you share this blog with us.

ReplyDeleteCritical Care Injection Franchise Company

Critical Care Medicine Franchise

I saw you have unique skills in writing content. Thanks for sharing such kind of information with us.

ReplyDelete#Third Party Pharma Manufacturers #Third Party Manufacturers #Third Party Manufacturing Pharma Companies #Third Party Medicine Manufacturer #Third Party Manufacturing Company #Pharma Third Party Manufacturing Company

I am so grateful for your article. Much thanks again.

ReplyDelete#Third Party Manufacturing #Top Third Party Pharma Manufacturers in India #Third Party Manufacturers #Pharma Third Party Manufacturing #Third Party Manufacturing in India #Third Party Pharma Manufacturing #Third Party Manufacturing Pharma #Third Party Manufacturing Pharma Companies

You did a very good submission and research about the topic.

ReplyDeleteCustom Made Equipments For Pharmaceutical - https://sspharmaequipment.com/

The nation needs quality healthcare and this means that the pharma industry needs to develop faster. The main problem that is faced by thepharma manufacturer India. is the lack of research components and also the lack of good manufacturing practices in real-time

ReplyDeleteNice blog on Contract Manufacturers Partner in USA

ReplyDeleteThat's Nice awesome blog.

ReplyDeleteapi pharmaceutical

This fabulous blog, is very helpful

ReplyDeletePharmaceutical Fine Chemicals

Awesome blog! Your blog is very informative for everyone. Chemxpert Database is world's most innovative online platform using our very own data intelligence algorithms, providing information of global buyer and suppliers of API and chemicals.

ReplyDeleteAcarbose DMF

Enalapril DMF

Fenoldopam DMF

Lanreotide DMF

Nice blog!! India's Contract Manufacturers offer cost-effective solutions with high quality and expertise in various industries.

ReplyDeleteNice Info on contract manufacturing partners

ReplyDeleteHelpful article! For reliable mortgage advice, visit hgv training

ReplyDelete

ReplyDeleteExcellent breakdown of the CDMO / CRAMS / API landscape – very insightful. The trends you point out, especially around regulatory challenges, capacity expansion, and maintaining innovation, are crucial for anyone interested in contract manufacturing. Thanks for sharing this; it gives a clear view of where opportunities lie in pharma outsourcing today.

Very well written article. It was an awesome article to read. Complete rich content and fully informative. I totally Loved it. Read more info about adc cdmo

ReplyDeleteTyndal Labs' expertise in custom research and manufacturing truly sets them apart in India’s pharmaceutical industry."

ReplyDeleteCustom research development manufacturing in india

Insightful overview of how global customization is shaping modern product experiences — tailoring packaging truly plays a big role in consumer perception. For businesses looking to elevate custom packaging quality and durability, using premium Bopp Thermal Lamination Film from Kingchuan Packaging can help enhance visual appeal and protect printed designs during production and handling. High-performance films like this support stronger brand presentation and long-lasting finish.

ReplyDelete