Biosimilars - The upcoming trend in Pharmaceutical Sector

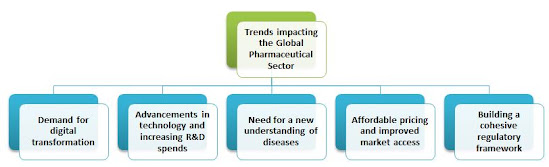

1. What are the trends impacting the global pharmaceutical sector?

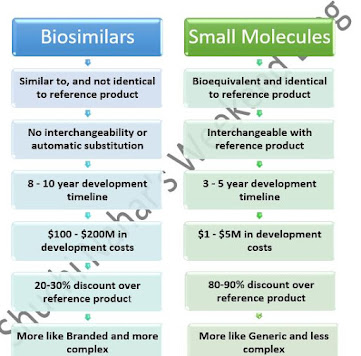

2. How are Biosimilars different from Small Molecules?

Figure 1: Comparison of Small Molecule and Biosimilars

Figure 2: Molecule Size - Small Molecules to Biologics

3. Procedure for Biosimilar US FDA Approval

Biologics contain active substances derived from living cells or organisms, the development of a biosimilar is much more complex than the process for developing a generic drug. A biosimilar requires the creation of a new manufacturing process and a custom cell line since the reference product’s manufacturing process is proprietary and not publicly available.

Due to the complex nature and production methods of biologics, relatively minor changes in manufacturing processes may significantly affect product quality, safety, and the criteria by which similarity is determined.

*Below (Figure 3) is just an illustrative example for the approval procedure of Pegfilgrastim biosimilar, which gives an idea about the time required for a biosimilar to develop and reach the markets.

Development Process of Biosimilar in US Market

*An illustrative example for the procedure for Biosimilars approval

Figure 3: Step by Step Development Process

(Source: BIOCON - Biopharmaceutical Company )

A biosimilar may require more analytical characterization and nonclinical studies than reference products, it may need fewer clinical trials and clinical pharmacology studies than its reference product to obtain FDA approval. Due to this reliance on the FDA’s previous finding of safety and effectiveness for the reference product, a biosimilar may have a shorter and less costly development program.

4. Evolution of Biosimilars and their approvals in US market in last few years

Since the first biosimilars entered the US marketplace in 2015, 28 products have been approved to date. The US marketplace is poised to welcome many new biosimilars from 2019-2022, spurring competition that will potentially lead to significant savings for the healthcare system. Essential components of provider and patient use of biosimilars include addressing the clinical, operational, and economic considerations to drive adoption as well as payer coverage.

Figure 4: Evolution of Biosimilars and rising approvals

Source: Bill of Health - Harvard Law

Biosimilars have a bright future if additional work is done to be attractive to prescribers and payers. Trends show that providers are already aware of biosimilars and are interested in learning more about them. Similarly, payers are showing a desire to adopt biosimilars to foster a successful marketplace and realize savings. From the above chart, we can see the evolution in Biosimilar approvals that have accelerated in past years and will continue for the Long term in the future. This thesis can be supported by the below (Figure: 4) that shows the increase in biotechnology % Prescription & OTC Sales.

Worldwide Prescription Drug & OTC Pharmaceutical Sales

Figure 5: Biotech vs. Conventional Technology

Source: Evaluate Pharma -World Preview 2020

Biotechnology products are forecast to take the majority share in the top 100 drugs by sales by 2026, with 55% of the total top 100 product sales in 2026, up 16% compared to 2012. Global prescription sales of biotech products to grow with a CAGR of 9.6% between 2019 & 2026, compared to conventional product growth of 5.5%. Biotech products are forecast to take a 55% share of the total top 100 product sales in 2026. The above chart justifies the increasing trend of biotechnology in coming years whose evolution has already started from the year 2017 onwards.

5. Opportunities & Market Size for Biosimilars

The global biosimilars market size is expected to grow by $240 billion by 2030. In today’s emerging markets, biosimilars are still nascent, with little presence.

However, in contrasting emerging markets with developed markets, the limited patient access

to affordable biologics and the openness of physicians to low-cost therapies may offer potentially significant opportunities.

The industry continues to shift towards

Biotechnology

Figure 6: Worldwide Prescription Drug & OTC Sales by Technology (2012-2026)

Source: Evaluate Pharma -World Preview 2020

As the number of prescription drugs expected to rise from $940bn (FY20) to $1432 bn (FY26), there is a positive outlook for biosimilars. The FDA appears to recognize the need to evolve standards over time. As biosimilar manufacturers and regulators gain experience and confidence, and technology advances, this kind of flexibility – grounded in science – will be important for fostering a thriving US biosimilars market. A maximally streamlined development, application, and approval process will be all the more vital for biosimilars of orphan or small-market biologics.

Developed markets, with the exception of the United States, represent the greatest biosimilars presence today Most biosimilars manufacturers have been and remain focused on the developed markets – whether it is for their historic and current opportunities (EU) or for their future market potential (United States, Japan).

7. The greatest evolution for the pharma sector

More importantly, biosimilars and their originator products accounted for $40 billion in spending in 2019. This expenditure was across several key therapy areas where further biosimilar entry would significantly impact healthcare costs. Biosimilars have the potential for substantial system savings. Therefore, biosimilars spending is expected to reach $16-36 billion by 2024 Source: Biocon Ltd. Annual Report

The recent upsurge in approval and launches of biosimilars, mainly in oncology, has boosted biosimilar penetration. Besides, small molecules continue to play a significant role in innovative treatments in oncology, diabetes, respiratory and autoimmune diseases and represent close to 60% of the total medicine spending compared to biologics.

There are listed Indian companies that have shown remarkable progress in biosimilars and have an exponential pipeline for the same that will result in good fortune in the coming times. To name the few they are:

Biocon - U.S, Europe and ROW

Lupin - Europe

Dr. Reddy’s - Domestic Market

Cadila Healthcare - Domestic Market

Syngene (CRO,CDMO & Biologics) - U.S, Europe and ROW

References: ESMO Munich 2018

Lessons for the United States from Europe’s Biosimilar Experience - Matrix Global Advisors

AMGEN Biosimilars

Deloitte - Biosimilars Research Report

Evaluate Pharma - World Outlook 2020

BIOCON - Fulphila BiosimilarDrug Approval Process

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links, references, and a compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Comments

Post a Comment