Neuland Labs - Company Snapshot

Neuland Laboratories Limited - Company Overview

Shuchi.P.Nahar - @shuchi_nahar

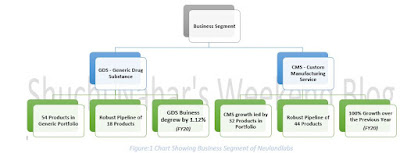

Neuland is a leading manufacturer of active pharmaceutical ingredients (APIs) and an end-to-end solution provider for the pharmaceutical industry’s chemistry needs. The Company operates in the market using two main business models - Generic Drug Substances (GDS) where they cater to the needs of the Generic players and Custom Manufacturing Solutions (CMS) where they primarily work with innovators by helping them bring critical products to the market. CDMO is the emerging growth segment of the company with 13 to 17 Molecules in development phase.1.

Business Performance

Neuland

lab (NLL) has posted revenue of INR 2,054mn with 13.5% YoY increase, which was

4% below. The revenue growth was mainly driven by the CMS segment, led by 32

molecules (Development + Commercialize) with speciality API segment, which grew

by 33.2% in Q1FY21. EBITDA margin expanded by 622bps to 16.5% level, which was

219bps higher than our estimate driven by 580bps improvement in gross margin

led by improved product mix.

Management

is confident to improve margin profile from current level on the back of strong

order book in CMS business, better traction in GDS business and cost

optimization measures. In terms of emerging CDMO player Company has couple of

molecules go up from 13 to about 17 in the development Phase-and from 14 to

about 15 in our commercialization phase. Some of these molecules are generating

part of the growth & some of the revenue growth is also coming from the

increase in the number of projects itself. Most of the molecules are in their

last phase of approval, that means there are more chances of approvals coming

in years. API & CMS both have healthy pipeline for future growth.

2. Revenue Growth 2019 v/s 2020

Revenue in the year 2019 was Rs. 670 Cr. Of which 54% was contributed from Prime Segment, 25% from Niche/Speciality Segment, 14% from CMS Segment and rest 7% from others Revenue in the year 2020 was Rs. 766 Cr. Of which 46% was contributed from Prime Segment, 27% from Niche/Speciality Segment, 21% from CMS Segment and rest 6% from others.

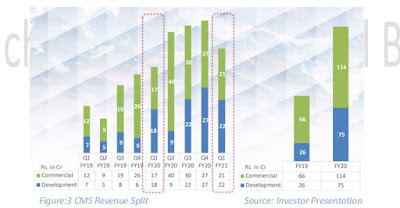

3. Key

Operating Metric – CMS Revenue Split

4.

R&D

Expenditure

In terms of

expense 2% R&D as a proportion to revenue. The R&D team has been a

crucial partner in the growth of the CMS business managing the spike in number

of projects while also making significant contribution in terms of Process

Improvement & Development (PID) work for the GDS business.

A pilot

plant has been commissioned at Unit III, which enables our team to further

accelerate the process of development of new products.

Unit III is

being operationalized which will add to the capacity and revenues from FY21.

Company commissioned a pilot plant at Unit III for use by the R&D team. It

will primarily be used to manufacture engineering/ development batches.

5.

Regulatory Filings by the Company till Date

in various Countries

880+ DMFs filed.

300+ API processes developed.

204+ patents filed.

Received USPTO patent for improved process synthesis of Paliperidone Palmitate.

6. Investment

Capital

investment during the year stood at 347.18 lacs. The Company enriched its

assets pool with new XRPDs, HPLCs, ICP MS, LCMS, and PSD equipment. This would

help increase project management and document filing capability.

It’s expected

the contribution from the high-volume segment to be gradually replaced with the

CMS segment and to register healthy revenue growth of 26.6% over FY20-22,

fuelled by the ramp-up in supplies of existing products and possible

commercialization of products in clinical trials.

7.

No of CMS Active Projects Increasing

8. Management Guidance

Capex for FY21: INR700-INR 800mn.

Unit 3: To fully commercialize from Aug 20, existing capacity sufficient to cater 2-3 years revenue. growth Awaiting more clarification from government on incentive scheme for API manufacturing.

NLL has 4 APIs out of 53 critical APIs where India has a large dependence on China.

Remain optimistic about the growth of CMS business.

9. Future Outlook

There is a lot of traction on the CMS new projects as well as good growth

in the baseline of the CMS business which is the traditional whole CMS company

had for several years.

The outlook remains positive especially because the two markets that Neuland

is focusing on Japan and North America and their pipeline of opportunity looks

quite strong the pipeline of projects that have entered the system in the last

3 to 6 months are quite advanced in nature, like say 3 molecules are about to

get into commercial.

These are opportunities which have a shorter cycle for commercialization.

So, unlike say 4-5 years ago, where the company was mostly engaged in phase I,

phase II projects now they are all in the last phase and they would go through

a natural attrition and a long cycle.

References: Neuland

Annual Report 2019-20 & 2018-19

Neuland Investor

Presentation & Conference Call Transcripts

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for

educational purposes only. The articles may contain external links , references

and compilation of various publicly available articles. Hence all the authors

are given due credit for the same. All copyrights and trademarks of images

belong to their respective owners and are used for Fair Educational Purpose

only.

Twitter Handle : @shuchi_nahar

This is of a great help..thanks a ton mam

ReplyDeleteAbsolutely thanks for nourishing the necessary information. I appreciate to u, all are such good information, Thanks. Pharma Manufacturing Company in Lucknow

ReplyDeleteI saw you have unique knowledge of pharmacy . Thanks for sharing such kind of information with us. Pharma Manufacturing Company in Lucknow

ReplyDeleteThanks for sharing such amazing information. I hope you keep on sharing such kind of useful information daily. Being one of thePharma Manufacturing Company in Lucknow

ReplyDeleteTyndal Labs is a valued partner for pharmaceutical growth globally because it provides expertise in API intermediates production from Hyderabad, guaranteeing product purity, regulatory compliance and technical innovation.

ReplyDeleteapi intermediates manufacturer in hyderabad

This comment has been removed by the author.

ReplyDelete