Syngene International Limited - Company Overview

Link to FY 2020-21 Annual Report takeaways - https://myweekendspot.blogspot.com/2021/10/syngene-international-ltd-fy2020-21.html

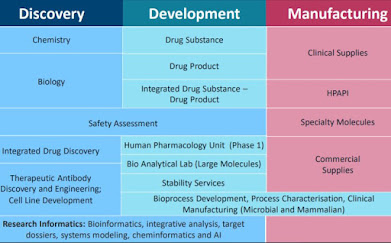

1. Company Overview

Incorporated in 1994 as a subsidiary of Biocon,

Syngene International (SIL) is a leading contract research organization (CRO),

which supports R&D programs of global innovative companies

SIL offers outsourced services to support

discovery and development for organizations across industrial sectors like

pharmaceuticals, biopharmaceuticals, nutraceuticals, animal health,

agro-chemicals, etc. It currently caters to 293 global players including

Bristol-Myers Squibb (BMS), Abbott, Baxter and Amgen, among others. SIL derives

95% of its revenues from exports. Mangalore API plant is constructed and

validation is expected to be completed in FY21. In FY20, Syngene extended its biologics discovery and preclinical

research capabilities in CAR-T therapy, an innovative cell-based approach to

treat cancer.

Received approval from the Russian Ministry of Health the approval

process was triggered as a result of a 4-year project with a Russian customer

in which Syngene supported in the development and supply of multiple,

modified-release tablet formulations of a multiple sclerosis drug.

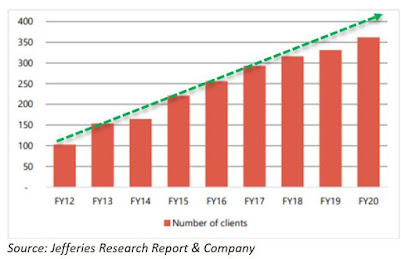

2. Integrated business model – Ground

for customer stickiness - Revenues grew at ~16% CAGR in FY16-20 to

Rs. 2012 crore due to new client addition on a regular basis and scaled up

revenues from existing clients led by integrated service offerings, high data

integrity ethos and continuous endeavour to move up the value chain.

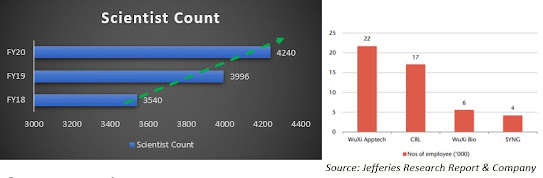

- Eight of the top 10 global pharma companies

have been availing services for the last five years. It has a pool of 4240

scientists. The client base has grown from 256 to 362 over FY16-20.

3. Segmental

Growth Year on Year from past 3 years

CRAMS and R&D

growth, Biologics is also in line for growth traction sequentially Revenue

increased 13% YoY to INR17.5b (in-line) in FY20, mainly led by strong growth in

Biologics (+31% YoY, 34% of sales) and Small Molecules (+16% YoY, 31% of

sales). Research Services (30% of sales) grew 11% YoY to INR5.2b. However,

Branded Formulations (9% of sales) de-grew by 26% YoY.

4. Rapid Increase in Revenue - Trend over the Years

Source: Company

Growth driven by increase in sales from

existing clients and acquisition of new clients

Engage, expand and extend strategy to

extend client relationship over a longer period of time

Growth in total number of clients

Increase in average revenue from largest

clients

Increase in number of services offered

to clients

5. Increase in number of Clients

6. Increase in number of Number of Asset

On a US$550 million program that

was spread over multiple years, the last year of which is FY21, it’s expected

to be fully invested with all US$550 million by the end of this year. During

the last 12 months, the company added US$108 million of that capex. With this

capital infusion, company’s fixed assets currently stand at US$425 million.

This includes an asset under construction of US$70 million.

Company is very much on track to

have a total asset base of US$550 million by the end of the FY21. Capex in FY20 stood at 108mn USD,

of which

• 43mn USD in API

• 28mn USD in Discovery

• 12mn in Biologics

• 25mn USD in others

• Total gross block stands at

451mn USD including 33mn USD of CWIP

• It commissioned a new research

facility (152K sq. ft.) supporting biology, QC microbiology and other research

domains.

• It is currently working at 70%

utilization and expects to hit 100% by end of May.

• It expects to achieve at least

1x asset turnover with revenue build-up by second

year of asset

• Revenue build-up for

manufacturing will take longer

8. Mangalore Facility

In FY 20

the company capitalized their Mangalore API plant which is reflected in the

number.US$100 million from the past was the total money company estimated for

the fully expanded capitalized plan. The US$75 million corresponds to the

current level of execution that company has targeted by FY21. But the company

plans in a later stage to expand it further. Total Capex

in the plant is USD 75mn and will be depreciated over 18yrs.

•

Construction is now completed

• It is in

validation phase

• It

expects to commence GMP commercial operations towards end FY21

9. Scientist Count

Scientist strength addition, the company has

typically added between 450 to 500 people on an annual basis over the last five

years. Now in FY20, the company added about 240 to 250 people. Syngene

still has large room to grow in terms of scientists.

10. R&D Centres – Growth Engines

To maintain the structural balance and

improve profitability, they are inclined to outsource a substantial part of the

R&D work. Similarly, the innovative/virtual companies that are extensively

working on new products and which may not have the required capital/manpower

also tend to outsource a substantial part of their R&D. Track record

in acceptance of Recent Approvals

●

Now one of Syngene’s

strengths is their strong track record of regulatory compliance and over the

course of the last year, they have cleared audits not only by their clients, but also by regulators from across

the globe and that includes the US FDA, the European EMEA, Japanese PMDA and

others.

●

Collaborations and

partnerships to deliver numerous clinical candidates. Delivery history for

integrated CMC programs towards FIH and beyond. Company has recently been

approved for selling oral formulations in Russian markets.

●

It successfully cleared USFDA inspection

of the small molecule bioanalytical laboratory within the clinical development

service line with no observations. The company commissioned the first phase of

a new research facility in Bengaluru that will house discovery biology, QC

microbiology and other research capabilities.

●

Syngene undertaking manufacturing of

innovator drug APIs. It increases its revenue base, and also helps it offer

bundled and diversified services to its customers.

●

The company remains aggressive on the

capex front (~US$463 million already spent & another ~US$87 million

earmarked by FY21), attributable to order book visibility.

●

With elite client additions like

Amgen, Zoetis, Herbalife, GSK, etc, and multiple year extension of BMS and

Baxter contracts, the company remains well poised to capture opportunities in

the global CRO space.

●

The management has guided for

double-digit revenue growth on the back of continuous client additions, an

extension of existing contracts, increasing manufacturing and biological

contributions besides currency tailwinds.

Source: Syngene Annual Report & Investor Presentation

Jefferies Research Report

Axis Research Report

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links , references and compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Nice article suchi..

ReplyDeleteThank you Madam

ReplyDeleteSuperb Coverage..please keep up the good work

ReplyDeleteThank you for all the information, you rock :-)

ReplyDeleteThat is really an informative post. Genscriptprobio offers a one-stop service for antibody discovery and PK analysis. To know more about our Anti-idiotype Antibody services, contact us now.

ReplyDeletePlease mention the negatives also

ReplyDeleteI read your blog. A Contract Research Organization or Clinical Research Organization (CRO) is an assistance association that offers help to the drug and biotechnology businesses as reevaluated drug research administrations. The provided information is very useful for contract research organization in India. Keep continuing to post further.

ReplyDeleteI read your blog. Contract Research Organizations reduce the expense of innovative work to assist organizations and establishments with addressing the necessities of the advancing clinical device and pharma industry. The provided information is very useful for contract research organization. Keep continuing to post further.

ReplyDelete