Dishman Carbogen Amcis - Fully Integrated CRAMS Player

Dishman Carbogen Amcis - Company Overview

Twitter Handle: @shuchi_nahar

Company Profile

Incorporated in 1983, Dishman Carbogen Amcis Limited (DCAL) started out as a manufacturer of quaternary ammonium and phosphate compounds. Having ventured into the CRAMS space in India, the company soon became one of the fastest growing companies. Today, company is a leading global outsourcing partner for the pharmaceutical industry, offering a portfolio of development, scale-up, and manufacturing services.

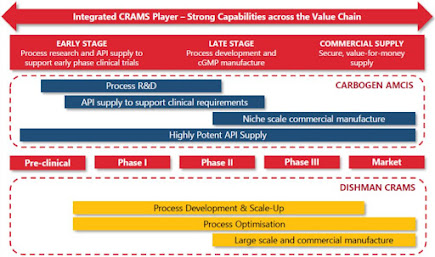

Company is a fully integrated CRAMS player working with global pharmaceutical innovators. Company has a global presence with development and manufacturing facilities across Europe, India, and China. Company provides end-to-end, integrated, high-value, niche CRAMS offering, right from process research & development to late-stage clinical and commercial manufacturing facilities along with the supply of Active Pharmaceutical Ingredients (API) to innovator pharmaceutical companies.

Developments till Date

1. The company delivered a resilient performance in FY2020 despite a challenging external environment. 2. Net Debt reduced to US$ 100 million as of 31st March 2020 from US$ 112 million in the previous year.

3. CAPEX of approximately US$ 42 million was incurred in FY2020, largely on account of maintenance across all of our plants and growth-CAPEX for the new building in Switzerland and the soft-gel capsule plant in India.

4. During the year, four NCEs got various regulatory approvals, where they were the development partner. The company continues to have a strong basket of about 18 APIs in Phase III development.

5. The company maintains high-capacity utilisation at its manufacturing facilities by focusing on small and mid-sized global biotech companies and diversifying across new geographies. The company will continue to focus on low-volume, high value orders, which will expand margins and drive profitability.

6. Among other highlights, Dishman announced buyback to the tune of ₹72 crores during the fourth quarter of the year.

7. 28 dedicated R&D Labs, including HIPO labs 25 multi-purpose facilities globally.

The company has a strong basket of about 18 APIs in Phase III development. The company is focused on improving its capacity utilization at its manufacturing facilities by targeting small and mid-sized global biotech companies and diversifying across new geographies.

Company plans to undertake growth capex of USD 70-75 million over the next three and a half years. Of this, it plans to incur USD 30-35 million for capacity augmentation in Switzerland over the next 2 years to increase the total capacity by 20%-25%.

The management expects the incremental capacity augmentation, along with continued technology transfer of molecules/intermediates to India and China will create adequate capacity in Switzerland in the near-to-medium term. Company plans to incur the remaining USD40 million - 45 million for setting up a greenfield facility for injectables in France.

Research and Development

Large dedicated R&D centre with multiple shift R&D operations. Multi-purpose and dedicated production facilities for APIs, intermediates (India, Europe and China). Dedicated API manufacturing capacities.

Team Strength of 2,200+ Committed Members Embracing our Culture of Innovation & Sustainability Dedicated Team/Scientist Working in R&D - 950+ 50% of Technical Staff holding Ph.D. 28 dedicated R&D Labs, including HIPO labs 25 multi-purpose facilities globally.

Strong capability to handle Highly Potent Compounds. 7,500 m2 of cumulative R&D floor space 1,043 m3 of cumulative reactor capacity.

Integrated CRAMS Player

Present along the entire value chain from building blocks to commercialization and product launch stage:

1. Drug Lifecycle Management

Preclinical to commercial manufacturing capabilities. Ensures seamless process & technology transfer from lab to plant. Single partner for R&D, process development and commercial production.

2. Strong R&D Capabilities

Globally, Dishman group has ~550 scientists, with 50+ doctorates as senior scientists.

3. Close Proximity to Clients

Local representation, local support in all major markets. Front end via CA with access to more than 200 established customer relationships of CA. Trust & Confidence of customers for entire drug life cycle engagement.

4. Large Scale Manufacturing Capacity

Dedicated USFDA inspected production facilities. Asia’s largest HIPO facility in Bavla. Large capacities provide competitive edge to win big long-term contracts.

Full scale and commercial supply

- 12 manufacturing plants

- US FDA inspected facilities

- > 1150 m3 cGMP reactor capacity

- Skills and capabilities encompassing all routine chemistries and a wide range of sophisticated modern technologies

- Multi-site, multi-country locations

- Over $40M invested in the last 3 years

Restructuring India Manufacturing Operations – HIPO Facilities

Alongside resuming manufacturing for CRAMS clients, company is also working to transform the India business by modernizing its manufacturing infrastructure. The company is investing in automating operations and trimmed its workforce from 1600 to 850 as it is investing in automating manufacturing lines. The company has also appointed Paolo Armanino (head of their HIPO plant) as CEO of India Operations.

New Product Development Pipeline of 86 Million CHF Total FTE 580 personnel in March 2020, up from 402 in March 2016, in Carbogen Amcis 18 products in Late Phase 3 and Validation stage Next phase of Vitamin D Analogues underway, with 2 patent applications and plans for Phase 1/2 trials in Obesity.

The Dishman Carbogen Amcis Group has a pipeline of orders exceeding US$ 160 million, as on March 31, 2020 for FY2020.Company has built a very strong pipeline of APIs, across various development phases and more significantly in late Phase III, which gives us a tremendous visibility for the next 3-5 years.

The Vitamin D analogues business is witnessing healthy growth and our focus has been to increase our Vitamin business by way of researching novel applications of our Vitamin D analogues.

18 more projects are close to approaching commercialization. Company is very satisfied with the fact that they managed to transition from development into validation and through to commercial stage at a rate they had envisaged.

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links , references and compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Twitter Handle: @shuchi_nahar

Comments

Post a Comment