Granules India Ltd - Large - Scale Vertically Integrated Company

Granules India Ltd. - Huge Scope of Growth Ahead

Twitter Handle: @shuchi_nahar

Company Overview

Founded

in 1991, Granules India Limited is a large-scale vertically integrated Company

manufacturing Active Pharmaceutical Ingredient (API), Pharmaceutical

Formulation Intermediate (PFI) and Finished Dosage (FD). The Company over the

years has created a strong presence in ‘the first line of defence’ products

such as Paracetamol, Ibuprofen, Metformin, Methocarbamol, and Guaifenesin.

Till

date, Granules has filed 45 ANDAs, received approval for 29 products (12 in

FY20) and launched five in the US. EBITDA margins have seen improving from

better product mix, operating efficiencies and higher capacity utilisations.

Also, the margins are expected to further expand with the launch of own label

products in the US, a new facility commenced at Vizag and using its own

Metformin with new capacity commissioned.

In FY20

it received approval for 12 ANDAs. It has a further 16 ANDAs (45 cumulative

filings) pending approval with the US FDA. The company plans to file 20-25 ANDA

filings from India and Virginia's facilities put together over the next three

years.

Company

has its dominance in key APIs such as paracetamol, ibuprofen and metformin are

likely to help Granules emerge as a prime beneficiary since the Covid-19

outbreak has led to a surge in demand for such drugs. Granules is likely to

maintain strong traction for the next couple of years, driven by formulations

and the healthy contribution from the new capacities.

Revenue & EBITDA trend over the years 2008 – 2020

Product Revenue Breakup - Recent 3 Years

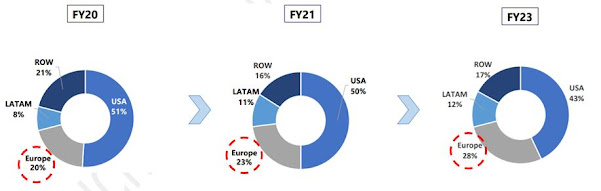

Geographic Revenue Breakup - Recent 3 Years

Under-Utilized

Capacity

Granules will focus on asset sweating as the newly

installed capacity is under-utilized. Key molecule capacity is underutilized

and waiting for regulatory approvals. Currently, Paracetamol capacity

utilization is at ~60- 65%, Metformin ~15% and Guaifenesin is undergoing

validation process.

Carlyle

Group in advanced stages to acquire Granules India for $1 billion:-

·

Granules India,

which has been on the block for a while may have found a buyer in large private

equity firm Carlyle Group, which has been active on pharma investments.

·

Granules

India has been exploring options to sell stake due to favourable valuations and

succession issues.

·

Carlyle

is in advanced stages to acquire Granules India for around $1 billion.

·

Carlyle

is expected to buy promoter shares which will trigger an open offer to acquire

additional stake from others. Carlyle recently acquired Sequent Scientific and

bought a minority stake in Piramal Pharma.

US Generics US

Generics - Opportunity from Core and Non-core products expansion:

In FY20 it received approval for 12 ANDAs. It has a further 16 ANDAs (45 cumulative filings) pending approval with the US FDA. The company plans to file 20-25 ANDA filings from India and Virginia's facilities put together over the next three years.

·

Received 2 awards from US government for products

made in GPI.

·

24 Rx ANDAs filed and 16 ANDAs approved currently. 8

products to be approved. 11 products under development between GPI and GIL (Rx)

·

Granules India Ltd US Generics: Granules

Pharmaceuticals Inc. (GPI)

·

Expect 3 launches in FY21, with an addressable

market size of about $1 Bn based on IQVIA (brand and generic). GPI

revenue in FY20 is at INR 2,960 Mn.

·

Core molecules include Paracetamol, Ibuprofen and

Metformin. Core molecules will keep increasing in absolute terms on an account

of expanding it to new geographies.

·

Gained traction with a first to generic product -

Methergine in June 2018. Set up a front end sales and marketing division and

launched 11 products under the GPI label: “Control your own destiny”.

·

Granules India expanding the base business by

entering into new geographies (Europe, Canada, South Africa).

·

The last paracetamol manufacturing plant in Europe

was closed in 2008, while India & China produces nearly 60% of the world’s

paracetamol.

·

Higher contribution from FD continues to grew in

absolute terms from INR 3,515 Mn to INR 4,301 Mn, up 22% YoY.

· Filing new ANDAs (7-8 ANDAs per year. 2-4 dossiers

per year and value added DMFs/CEPs/EDMFs).

·

Focus on developing controlled substances and

niche/differentiated modified and extended-release products in varied dosage

forms.

·

Average launches 7-8 ANDAs/Dossiers per year. Focus

on operational efficiencies and process innovation through R&D.

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links , references and compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Twitter Handle: @shuchi_nahar

Comments

Post a Comment