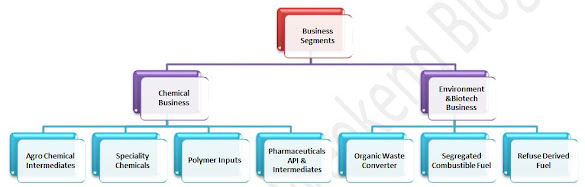

Excel Industries - A Diversified Chemical Giant

Excel Industries Ltd. - A Diversified Chemical Giant

Company Overview

Excel Industries Ltd., one of India’s first domestic

chemical manufacturers. We are pioneers in indigenous chemical technology and

sustainable waste management. Innovation has always been a key driving force at

Excel. Since its inception in 1941, Today, the company is all set to embark on a

new phase of meaningful growth. Excel is one of India's premier manufacturers

of Specialty Polymer Additives and high-quality Veterinary APIs. The company is all set to apply its chemical

process know-how in the Pharmaceutical Intermediates industry while

continuing its leadership position in agrochemical intermediates and

phosphorous derivatives.

Industry Structure

– Chemical Business

·

The Size of the Indian specialty chemicals

industry is estimated at US $ 63 billion. Agrochemicals and Pharmaceuticals

(API & Intermediates) account for US $ 5.7 billion and US $ 12.8 billion

respectively.

·

The Company is a leading manufacturer of

specialty and performance chemicals.

·

Specialty and performance chemicals are

knowledge chemicals which require specialized skills and knowledge for

manufacture in terms of chemistry and engineering capabilities, material

handling and effluent treatment.

·

Specialty chemicals are required in a number of

end-use applications ranging from the Life Sciences (Agrochemical and

Pharmaceuticals) to Fast Moving Consumer Goods (FMCG). Production of specialty

chemicals require good knowledge of the requirements of the end-user

applications to whose needs they are meant to cater.

·

All specialty chemicals are subject to varying

degrees of regulatory requirements and the demand for these chemicals can be

impacted by changes in regulations.

(Source – Report of Credit Suisse on the

Agrochemicals segment & CII-KPMG report on Pharmaceuticals).

Industry Structure

– Environment Biotech Business

·

The Municipal Solid Waste Management activity in

India, which was hitherto fragmented and unorganized, is finally taking shape

of an organized industry on the back of streamlined legislation, legitimate

players.

·

In the wake of the COVID-19 Pandemic, the need

for scientific collection, treatment and disposal of waste will be highlighted

more than ever before.

Revenue Trend over

past 5 years

Segment-wise

Performance

The total sales turnover of the Company for the year 2019 –

20 was ` 702 crores as against ` 825 crores for the year 2018-19. The turnover

of the Chemicals Division for the year 2019 – 20 was ` 685 crores and that of

the Environment and Biotech Division was ` 17 crores.

Chemicals - Opportunities

in coming years

The company see good demand for the Organophosphorous (OP)

intermediates manufactured by the Company. The reason is that the good rabi

harvest has helped in depleting the channel inventories. The IMD has forecast a

normal monsoon in 2020 which augurs well for the demand of downstream

agrochemicals in the Kharif season.

The Phosphonate range of products finds application in

segments like water treatment, soaps, and detergents, industrial and

institutional cleaners (I & I), etc. The emphasis on sanitization and

cleaning in the wake of Covid 19 has meant a good demand for these products.

The demand from the US market has been good and we expect this to continue for

the balance of the year.

The Company has been able to establish itself as a serious

player in the pharmaceutical intermediates and API segment. The company is backward

integrated into these APIs and expects to consolidate its position and grow in

these products and it is also working on developing new APIs and intermediates.

In light of the supply disruptions from China in recent

years, there is a conscious strategic drive on the part of customers to

mitigate the risk of sourcing from China.

Environment &

biotech – Two major projects inline

The company bagged two key projects in the FY 2019-20. Operations

and Maintenance contract of 600 TPD Municipal Solid Waste Plant at

Varanasi for a period of two years starting January 2020.

Bio Mining of 900 TPD Legacy Waste at Ahmedabad starting January 2020

The ENBT business recorded a turnover of INR 17.78 Crores in the financial year

2019-20. The major contribution to the turnover is mainly due to the two key

projects mentioned above. The FY 2020-21 will be a challenging year. The demand

for Organic Waste Converter systems will below.

The Company will focus on additional sources of revenue to

make existing projects profitable, namely through the sale of Segregated

Combustible Fuel (SCF) and Refuse Derived Fuel (RDF).

Recent

Acquisitions to cater to rising demands in future

During the year, excel successfully acquired the

manufacturing unit of Net Matrix Crop Care, which is located in Andhra Pradesh.

The facility produces Sodium Trichloropyridinol which has a high-value

potential and can generate healthy revenues and profitability margins for The company, going ahead.

The acquisition of the Vizag site presents an exciting

opportunity to explore forward-looking strategic plans for the Company. Vizag

site is a fully functional plant, coming with regulatory clearances and adequate

open space for constructing new plants for products of the future.

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links, references, and a compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Twitter Handle: @shuchi_nahar

Maxwell Industries is the leading gasket manufacturer & supplier in Chennai, India. We manufacture all types of industrial gaskets.

ReplyDeleteGasket Manufacturers in Chennai

Great article!! Thank you for your post. This is excellent information. It is amazing and wonderful to visit your site.

ReplyDeletecustom chemical blending