Scope for Ready to Eat Food (Marketsize,Major Players, Changing Patterns)

Scope for Ready to Eat Food (Market size, Major Players, Changing Patterns)-Great opportunities Ahead

Twitter Handle: @shuchi_nahar

Global Ready To Eat Industry

Globally, the

demand for Ready-to-Eat (RTE) food has grown significantly and is expected

to reach US $172 billion by the end of 20231. Changing food habits, lack of

time and easy accessibility to various food groups have generated a huge demand

for these products. Driven by high disposable incomes, ease of use, busy

lifestyle, and better nutritive content, consumers globally are relying more on Ready - to - Eat food.

Ready to Eat Industry –Market size &

Growth

The global ready meals market size was valued at USD 159.15

billion in 2019 and is expected to grow at a compound annual growth rate (CAGR)

of 5.5% from 2020 to 2027. Shifting consumers’ food preferences towards ready-to-eat

food products owing to the busy lifestyle of working individuals as well as

hectic work schedules of college grads and students are expected to be a key factor for the market growth. Moreover, the growing demand for minimally

processed and additive-free food products with an extended shelf life is

expected to fuel market growth.

The Indian

ready-to-eat food market stood at $261 million in 2017 and is projected to grow

at a CAGR of over 16% during 2018-2023 to reach $647 million by 2023.

Anticipated

growth in the market can be attributed to rising urbanization, increasing

disposable income of the middle-class population and changing taste preferences of

Indian consumers. Moreover, the growing demand for quick food and the presence of

freshness and high nutritional value in these foods are further aiding the growth of

the Indian ready-to-eat food market.

The demand for

ready-to-eat food products is recording high growth in metros where a lot of

working people don't get enough time to cook proper meals. Additionally, longer

shelf life and easy availability of ready-to-eat food products is further

pushing their demand across the country.

The most popular

ready-to-eat items include preparations of paneer, chana masala, rajma masala,

pav bhaji, etc. The rise in the demand for ready-to-eat food products has created interest among many companies to enter this space which is likely to

contribute to the growth of the market in the coming years. Furthermore,

innovation in product offerings, sustainable packaging, preference for single-serving frozen products, aggressive marketing & promotional strategies

would steer growth in the market during the forecast period.

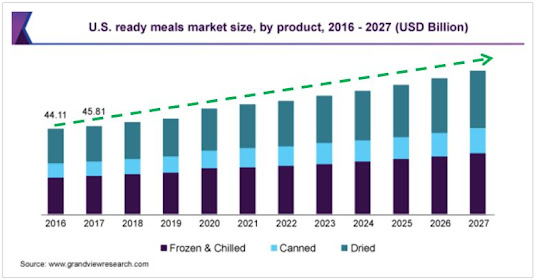

(Source: Grandview Research)

In recent years, employment has been growing across the globe,

which has changed the food preferences of the consumers. Customers around the

globe are more inclining towards food items that can easily be consumed without

any effort. Due to hectic work schedules, people around the globe are buying

Ready-to-Eat (RTE) food products and meals, which are easy to cook and less

time-consuming. These consumer food preferences are propelling the demand for

ready meals.Precooked or ready meals are highly convenient and they help

save time and effort required for meal preparation. This has led to an

increased demand for ready meals, especially among the working population and

students across the globe. Ready meals are a cost-effective alternative as they

are precooked. Moreover, the easy availability of ready meals throughout the year

will have a positive impact on their demand. In addition, print and media

advertisement has played a key role in creating awareness about ready meals,

thereby augmenting the overall market growth.

Frozen and chilled meals held the largest revenue

share of more than 50.0% in 2019 and are expected to maintain their lead over

the forecast period owing to a wide range of products with high shelf life.

Frozen pizza is the most popular frozen ready meal, thereby significantly

contributing to global revenue.

Canned meals are anticipated to expand at the

fastest CAGR of 6.1% from 2020 to 2027 owing to rising

popularity among young consumers across the globe. The dried product segment is

likely to witness significant growth in the future. Dried products include

foods such as instant pasta and noodles. Countries including the U.S., China,

India and the U.K. are the major markets for dried meals owing to substantial

demand.

Distribution Channel

Supermarket and hypermarket are the largest revenue

generators for the RTE market and are expected to maintain their lead over the

forecast period. Some of the largest chains of supermarkets and hypermarkets,

such as Walmart, Tesco, 7Eleven, Apar, and Aldi, are expanding their stores

across the globe. These market giants are increasing their product offerings in

order to attract customers.

The online retail segment is anticipated to expand at the

fastest CAGR of 6.2% from 2020 to 2027 owing to the growing trend of

online shopping among consumers. Increasing penetration of smartphones,

coupled with the rising use of the internet, is propelling the growth of e-commerce.

Food Service Industry in India

The INR

38,000 million Food Service market in India is mostly dominated by the

unorganized sector, contributing to around 62% of the overall market size.

Within the organized sector, QSRs (Quick Service Restaurants) and CDRs (Casual

Dining Restaurants) constitute about 80% of the market. The organized foodservice

segment is expected to grow at a CAGR of 13% between 2019-2024. The

growth is largely influenced by an increasing number of international brands, the emergence of food technology disruptors, strengthening of backend

infrastructure, acceptance of new cuisines, and changing lifestyles.

The RTE sector

has been evolving as the country has the highest millennial population (, people

aged 18 to 35), whose food habits and tastes are very different from those of

previous generations. Millennials today, happen to be tech-savvy, independent,

career-driven individuals with global exposure possessing a higher spending

capacity and with little time to cook indoors.

Rapid urbanization and high disposable income

With

the rapid urbanization, high disposable income, changing consumer lifestyle

which leads the urban people to suffer from a time crunch which is increasing the

demand for on the go convenience foods, thereby fueling the ready-to-eat food

market. Furthermore, with an increased willingness to spend on such food

innovative products with functional ingredients, convenience, and organic foods

and advancement in areas of packaging technology is anticipated to act as a

Ready to Eat Food key driver of the market during the forecast period

2020-2025.

Focus

on nutritious packaged foods

Many

families still compel their younger members to have home-cooked meals, due to

the lack of trust in RTE foods. This is causing many RTE companies in India to

focus on positioning their products as having high nutritional value. For

instance, McCain foods, though relatively new to the Indian market, provides

its customers with a range of delicious frozen foods, including French

fries, aloo Tikki and cheesy

bites.

Food processing technology

Food

processing technology has developed significantly in recent years and has

become a boon with regards to mass production of RTE foods on a commercial

scale.

Many

Indian companies are also now investing much more in terms of budgets and

manpower towards food-related R&D. This is resulting in a variety of

products reaching the Indian consumer.

Busy Lifestyle

Increasing the female employment rate is expected to propel the ready to eat food market. High

technological advancement such as microwaves has increased the demand for the

ready to eat food products.

Changing Food Habits and

Lifestyle

Rapid economic development

coupled with rising disposable income is driving the ready to eat food market.

Additionally, increasing working

population and changing lifestyle has encouraged the significant growth of

ready to eat food market during the forecast period.Ready - to - Eat food market (Region wise Penetration)

(Source:

Mordor Intelligence)

Major players, who are currently operating in

the Indian ready-to-eat market include Tasty Bites, Tata Consumer, Nestle, Britannia

Industries Limited, Hindustan Foods, Dabur India Limited, Godrej Agrovet, ITC, Marico

Limited, Heritage Foods Limited, etc.

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links, references, and a compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Twitter Handle: @shuchi_nahar

If you are always busy, try Fortune Exicom. They are a Food Manufacturer and Exporter serving Ready-to-Eat Meals for Busy Modern Lifestyles across many countries.

ReplyDelete