DMCC - Dharamsi Morarji Chemical Company - Company Overview

Dharamsi Morarji Chemical Company - Company Overview

The Dharamsi Morarji

Chemical Company Limited (DMCC), established in 1919, was the first producer of

Sulphuric Acid and Phosphate fertilizers in India. Over the years, the brand of

the Company (“Ship”) came to be recognized as the quality standard for Single

Superphosphate (SSP). Until recently, DMCC was known primarily as a fertilizer

producer, with over 75% of revenue from SSP. As a strategy, DMCC structured

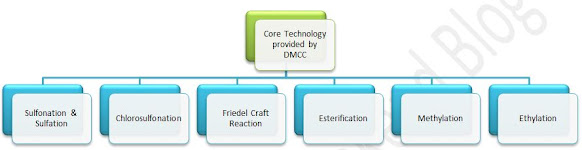

itself to Speciality Chemicals. With focused Research and Development efforts,

processes for downstream sulfur-based chemicals were commercialized.

Diversified

Product & Customer Base

The company has 34 unique products across bulk and

specialty chemicals. The company has a wide product basket that helps us in penetrating

new geographies and acquiring new customers. The chemicals manufactured and

applied in a wide range of industries across 25 countries.

Impact on Bulk Chemicals

Companies bulk chemicals had an unfavorable market

conditions and earned lower realization as compared to the previous year.

While they maintained their market share, the company did witness a decline in the

topline and bottom line. The company is in good progress with its plans to

debottleneck and expand operations in the Roha facility. The company is also adding

incremental capacity for sulphuric acid in Dahej, which will enable them to tap

new customers as they continue to be cost-efficient in their bulk chemicals

business.

Growth of Speciality Chemicals

Companies specialty chemicals business is progressing

well. Despite facing stiff challenges from Chinese competitors, the company has

managed to maintain strong demand for its products in export markets. Their

strategy going forward is to be a backward integrated specialty chemical

company. With this, their focus will be on strengthening the innovative funnel

to ensure aggressive growth. The company will be going under significant

transformation with an ambitious investment plan in this segment.

Growth in Sales over the years

Financial Performance for Q3FY21

The

revenues of the company in Q3FY21 increased by 16.95% to 47.33 cr. as compared

to 40.47 cr. in Q3FY20. The company recorded a strong overall performance

despite a planned maintenance shutdown of 35 days during the quarter. The

company also witnessed strong demand from the export market during the quarter.

Segment Performance for Q3FY21

The company witnessed a strong performance in the specialty chemicals segment with the reopening of domestic industries. The demand from export markets continued to

remain strong during the quarter despite the 2nd wave of COVID in European

countries.

The

commodity segment of the boron business continued to face a challenging environment with the availability of raw materials being a roadblock. However, the

company continues to witness traction on the specialty part of the boron

business.

The

volumes in the bulk chemicals business were subdued owing to the maintenance

shutdown. The company expects the volumes in bulk chemicals to recover from the

current quarter.

Bulk

chemicals at Dahej

The company will be investing 50 cr.

in adding incremental capacity in the bulk chemicals segment.

The company has been facing certain

challenges in terms of delays from vendors, however, the company is on track to

complete the project by June 2021.

Specialty chemicals at Dahej

The company will invest 20 Cr. in a

dedicated plant at Dahej facility. The company will use this facility for

contract manufacturing. The products to be manufactured and other details

remain confidential as the company has signed an NDA. The plant is expected to

begin commercial production in the 2nd half of 2021.

Debottlenecking at Roha

The company is progressing well on its

plans of debottlenecking at the Roha facility. The company will invest ~ 10 cr.

on this project. The company is on track to complete this project by April

2021.

Multipurpose plants at Dahej

The company will further invest Rs. 10

cr. in 2 multipurpose plants at the Dahej facility. The company plans to begin

commercial production in these multipurpose plants by the end of the current

financial year.

Intermediates Plant at Dahej

The company had plans to invest Rs. 20 cr. for

expansion to manufacture intermediates for the pharmaceutical and agrochemical

industry. This project is expected to complete by December 2021 The company had

earlier decided to invest this amount in Sulfones. However, with a downturn in

the international markets for the product category, the plan has been put on

hold.

Opportunities in

the domestic chemical landscape

The chemical industry already contributes to India’s trade volume.

Capturing emerging opportunities in the near term could make a positive

difference to the Indian chemical companies and to the industry in general. Diversification

of supply chains out of China coupled with stricter environmental norms is

changing the structure of the Chinese chemical industry.

These factors are causing

uncertainty among international players that source chemicals from China. This could create an opportunity for the

Indian chemical players in certain value chains and segments.

Steadily

shepherding the industry towards higher environmental standards, China’s

stricter norms are disrupting some parts of the chemical value chain.

Trade conflicts have erupted around the world, especially among

China, the United States, and Western Europe. These have led to shifts in supply

chains, affecting bilateral trade between China and United States, with

possible repercussions for other economies. Large chemical markets that

remain accessible could present opportunities for Indian

chemical companies. Sustainability is becoming an imperative, with various

stakeholders placing a premium on it. The government of China has set

provincial targets and is shutting down non-compliant companies. Chemical

companies that prioritize environmental sustainability while complying with

local regulations may stand to benefit from this opportunity.

Specialty chemicals are the leading Indian chemical export

segment, making up more than half (55%) of total chemical export value in 2018.

Yet they contribute only 3% of the total export value of specialty

chemicals worldwide. Compared to 13% for China, 11% for Germany and 5% for

Japan. There is enough room for growth for companies operating in this segment.

Focus on Research and Development

The company focuses

on the research-led conversion of generic materials into value-added niche

specialty chemicals. The company has been incrementally increasing its spending on

R&D to enhance their process chemistry skills, improve product quality and

process yields of existing products. R&D spend in the financial year ending

March 2020 stood at a life-time high of INR 2.25 cr. which is 40% higher as

compared to the previous financial year.

With a strong

focus on R&D and 2 manufacturing units, the company is well placed to benefit

from the upcoming industry opportunities.

Creating New Growth Platforms

In 2019 company

broke ground on their upcoming sulphuric acid and specialty chemical plant

spread across 1,03,000 sq. mt. the plot in Dahej. This will further enhance their

sulphuric acid capacity by 300 MT/day and expand their reach to new customers.

The

company will also add capacities for Benzene Sulfonyl Chloride, Sulfones, and a

range of Thio Compounds.

The company expects this unit to start by June 2021. With a

planned expenditure of about 50 cr. on the sulphuric acid plant, the company

expects to derive 1.5 - 2x fixed asset turns on this asset. This will be a

one-time investment that will take care of their sulphuric acid needs for the

foreseeable future.

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links, references, and a compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Twitter Handle: @shuchi_nahar

Explore seamless business establishment with Arab Business Consultant. Our expert team specializes in DMCC business setup, ensuring a smooth and efficient process. Benefit from our knowledge and experience to navigate the intricacies of DMCC regulations. Elevate your business with our tailored solutions. Contact us for a successful start.

ReplyDeleteThis article is amazing. It helped me a lot. Please, keep up the good work. We are always with you and look forward to your new interesting articles.

ReplyDeletechemical repackaging companies