Healthcare Global Enterprise Ltd. - Company Overview

Healthcare Global Enterprise Ltd. - India's Leading Oncology Focused Network

Background

Established

in 1989, Healthcare Global Enterprises Limited (HCG), is present primarily in

the oncology field with the largest cancer care network (with 22 cancer care

centers as of December 2021) and three multi-specialty hospitals. It is

promoted by Dr. B.S. Ajai Kumar, practicing radiation and medical oncologist

with over 30 years of experience.

Originally

established with a single cancer care center, the Bangalore Institute of

Oncology (BIO), at Bangalore by Dr. B.S. Ajai Kumar and four other oncologists,

the company has rapidly expanded its presence to Ahmedabad, Chennai, Nasik,

Ranchi, Rajkot, Cuttack, Hubli, Mumbai, Nagpur, Vizag, and Vijayawada, among

others. The company is now present across the oncology value chain, offering

services from prevention, screening, diagnosis, and treatment to rehabilitation,

supportive care, and palliative care.

Pursuant

to the Investment Agreement entered by the company and promoter with Aceso Company

Pte Ltd (CVC group) in June 2020 and subsequent equity infusion, a majority

stake of 56.8% (on a fully diluted basis) is now held by the CVC Group.

Established in 1981, CVC is a private equity and investment advisory firm with

US$ 114.8 billion of assets under management as of March 31, 2021. It has a

global network of 24 local offices - 16 across Europe and America and eight in

the Asia Pacific region.

Business Overview

Strand

Divestment

HCG

announced the acquisition of oncology hospital labs and clinical trials

business from Strand Lifesciences as well as simultaneous divestment of its approx.38.5%

stake (on paid-up capital basis and 34.5% on a fully diluted basis) in Strand to

Reliance Industries group company.

HCG

acquires majority stake in Suchirayu HealthCare Solutions

HealthCare

Global Enterprises Limited (HCG), the leading specialty healthcare service

provider in India focused on oncology, announced the acquisition of an

additional 60.9% in Suchirayu Healthcare Solutions (“Suchirayu” or “Company”),

Hubli, thereby becoming a majority stake owner from its existing 17.7% to

78.6%.

Suchirayu

owns a state-of-the-art multi-specialty hospital in Hubli with an operational

capacity of 110 beds and a potential to scale up to 250 beds.Services

provided by HCG Cancer Care

Each

of its comprehensive cancer centers offers, at a single location, comprehensive

cancer diagnosis and treatment services (including radiation, medical oncology,

and surgical treatments). HCG’s freestanding diagnostic centers and its daycare chemotherapy center offer diagnosis and medical oncology services,

respectively. HCG has one of the lowest doctor-related expenses (~15% of

revenues) and the attrition rate is just ~5%.Capex

phase to end between FY21 and FY23

HCG

was on a CAPEX overdrive between FY18 and FY20 when Rs 2,662 mn, Rs 2,199 mn, and Rs 2,141 mn were added to its gross tangible assets block in FY18, FY19, and

FY20 respectively. 9 new comprehensive cancer care centers were added between FY16

and FY20 which led to the decline in EBITDA margin and RoCE. HCG's new center

losses increased to Rs 455 mn in FY20 from around Rs 70 mn in FY17. While it

took about 1-1.5 years for the new centers to break even, Borivali and Nagpur

centers’ breakeven was delayed owing to the doctor and rent-related issues.

Net debt reduced compared to June 2021

HCGs net debt on consolidated books reduced by Rs. 67 crores to Rs. 226.8 crore. The reduction was because of Rs. 8 crore-10 crore improvement in FCF and amount

raised through stake sale in Strand Life Sciences.

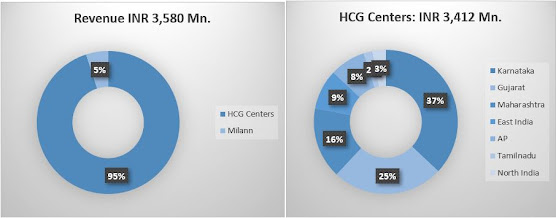

Revenue Snapshot for Q3FY22

1. Record

performance with ‘all-time high’ operating financials delivered across the

business:

Highest ever

quarterly Revenue and Operating EBITDA delivered during the quarter. Strong

yearly revenue growth on the back of higher footfalls. Consolidated Income from Operations (“Revenue”) was INR 3,581 mn as compared to INR 2,740 mn in the corresponding quarter of the previous year, reflecting year-on-year growth of 30.7%.

2. HCG New centers

continued their scale-up trajectory:

Strong revenue

growth of 54.2% y-o-y o Recorded positive EBITDA with several centers

witnessing a turnaround in EBITDA (unit level). Several regions delivered high

double-digit revenue growth on yearly basis on the back of gradual unlocking of

the economy.

3. Maharashtra's

upsurge continued across all centers and delivered 29.9% revenue growth y-o-y o

East India witnessed a continuance in its growth path with 35.1% revenue growth

y-o-y. North India recorded high growth of 147.9% y-o-y.

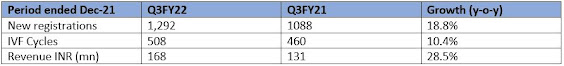

4. Milann revenues grew by 28.5% y-o-y.

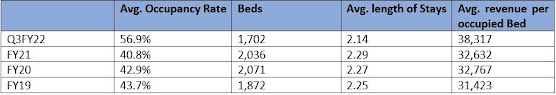

Operating Metrics

Milann revenue grew by ~57% y-o-y to Rs. 17.4

crore with new center revenue growing by 78% y-o-y. The business has registered

improved digital traction driven by a continuous focus on strengthening clinical

talent. The company is looking to focus on market leadership in Bengaluru and

scaling up North India centers in the near term.

HCG's new patient

registration has almost doubled since 2018 and the company currently has above 100,000

new patients per annum which in turn has doubled the revenue in the said

period. The fact that 85% of this revenue is Oncology centric is a clear

testament to their business model in addition to the deep social impact that they make on the lives of thousands of patients and their families. Looking at the

future, management believes that this growth will enhance not only the back

of the increasing longevity of patients but also a realization that cancer is

now being viewed as a curable and chronic disease with a good lifestyle.

This is the fourth consecutive quarter with all-time-record revenue

and the second consecutive quarter with all-time-record EBIDTA. Implementation of

go-to-market plans across their network locations during the last three quarters has

started showing results through this profitable growth.

Overall, these results were made possible through the execution focus

and hard work of the entire HCG team, and they remain committed to driving growth

and optimizing operations in the coming quarters. For the future, they want to

build a long-term relationship with their patients to be their trusted advisors over

a lifetime.

Link to Hospital Sector Overview-http://myweekendspot.blogspot.com/2022/01/hospital-sector-upcoming-gem-of.html

Twitter Handle: @shuchi_nahar

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links, references, and a compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Have they closed few centers? No of beds has gone down & even their average bed occupancy appears low.

ReplyDeleteI am very impressed with your post because this post is very beneficial for me and provide a new knowledge to me.

ReplyDeletePcd Medicine

Monopoly Medicine Company in India

Hi dear,

ReplyDeleteThank you for this wonderful post. It is very informative and useful. I would like to share something here too.Advance Pest Control offers most effective pest control services in and around Delta, Richmond, Tsawwassen, Burnaby and Surrey. Enquire today for free quote!

Ants control Mission

I just learned a lot from this post and first things first, I’m going right now to work on my blog design, which I know isn’t too appealing.

ReplyDeleteTop 10 Affordable PCD Pharma Franchise in India

Top 10 Affordable PCD Pharma Franchise in India

I have read your blog really so nice and helpful for me Thanks. There are a number of diverse activities involved in financial services and to let people know about all of them, advertising agencies play a very important role in online campaigns or ads and strategies, etc. There are ad agencies that specialize in financial services, like Arro Financial communication services, which offer a lot of services to their clients like public relations, branding, advertising, strategic positioning, content generation, and videos. As they say, they are a marketing communication agency specializing in financial services.

ReplyDeleteNice information, I believe that anyone who wants to know something about this topic will like the post. I really loved reading blog.

ReplyDeleteMedicine Franchise Company

Pharma Franchise Company in India

This post is amazing, this blog is very knowledgeable for readers .thanks for sharing this post,Keep it up

ReplyDeletePCD Pharma Companies in Bangalore

I adore reading and I conceive this website got some really utilitarian stuff on it.

ReplyDeletePharma Manufacturing Company in Gurgaon

This is a valuable read for both healthcare providers and new parents! Enhanced care management in San Diego County, California is helping bridge the gap between medical care and real-life support—especially for families navigating postpartum recovery or chronic conditions. Coordinated services and personalized care plans are making it easier for parents to access the help they need. Providers offering holistic, connected care are truly changing outcomes. It’s inspiring to see this approach gaining momentum in our communities! postpartum home care services, Remote antenatal surveillance , prenatal and postnatal care

ReplyDeleteSuch a good information! I really liked your post about best hospital.

ReplyDeletecallupcontact

federatedjournals

globhy

classi4u

edutous

enrollbusiness

adpost

independent

I generally want quality content and this thing I found in your article. It is beneficial and significant for us. Keep sharing these kinds of articles, Thank you.International expansion healthcare companies

ReplyDelete