Government Initiatives to boost Growth for Indian Chemical Sector

India's Growth Trajectory in Chemical Sector supported by Government Initiatives

Twitter Handle: @shuchi_nahar

The global chemicals market is valued

at around USD 4,738 billion and is expected to grow at 6.2% CAGR reaching USD

6,400 billion by 2024. The Indian chemicals market is valued at USD 166 billion

(~4% share in the global chemical industry) and it is expected to reach ~USD

280-300 Bn in the next 5 years, with an anticipated growth of ~12% CAGR. The

specialty chemical industry forms ~47% of the domestic chemical market, which

is expected to grow at a CAGR of around 11-12% over the same period.

Stronger

growth lead by Government Initiatives

India’s

growth story was largely positive based on the strength of domestic absorption

and the economy was registering a steady pace of economic growth pre-Covid.

Moreover, its other macroeconomic parameters like inflation, fiscal deficit and

current account balance had exhibited distinct signs of improvement. Though the

pandemic has led to a short-term slowdown of the economy, the medium-long term

fundamentals are sound & India is expected to witness the revival of its

economy soon.Aatmanirbhar

Bharat Abhiyan

Prime Minister Narendra Modi on May

12, 2020 announced the Aatmanirbhar Bharat Abhiyan which combined relief,

policy reforms and fiscal and monetary measures to help businesses and

individuals to cope with the situation created by the pandemic and helps

transform India into a self-reliant economy. The government seized the crisis to

push forward long-pending industrial & other economic reforms in the least politically resistant atmosphere.

• This campaign is especially expected

to benefit the Specialty chemicals sector, with several players hoping to

position themselves as an alternative to China as the coronavirus crisis

prompts companies to diversify their supply chains.

• Govt. announced a production linked incentive (PLI) scheme for the promotion and manufacturing of pharmaceutical

raw materials in India. The government’s move is aimed to boost domestic manufacturing and cut dependence on imports of critical Active Pharmaceutical

Ingredients (APIs).

Further, the government has also decided to develop three

mega bulk drug parks in partnership with states. These schemes will likely appeal

more to the smaller players and should foster more investments. The government

is soon planning to roll out such a scheme for the chemicals sector as well.

• The government is also in the

process of launching a production-linked incentive (PLI) for the chemical

sector to increase self-reliance in the country. This move is to reduce the country’s

dependency on imports of basic chemicals. The PLI scheme will help the sector

to identify import-dependent chemicals and work towards producing them within

the country.

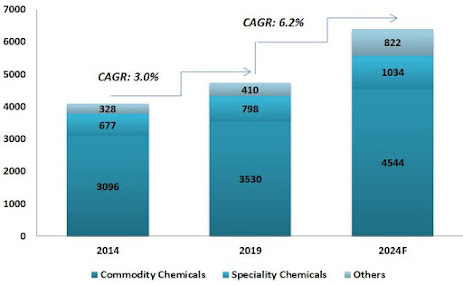

Global

chemicals market, 2014, 2019, and 2024F (USD 4100 Bn, USD 4738 Bn, and USD 6400

Bn)

Commodity Chemicals

The commodity chemicals market includes companies that manufacture basic chemicals in large volumes. These include plastics, synthetic fibers, films, certain paints and pigments, explosives, and petrochemicals. There is limited product differentiation within the sector; products are sold for their composition.

The commodities market is highly fragmented. The

end-user markets include other basic chemicals, specialties, and other chemical

products; manufactured goods such as textiles, automobiles, appliances, and

furniture; and pulp and paper processing, oil refining, aluminum processing,

and other manufacturing processes. Markets also include some non-manufacturing

industries. The sector is presently valued at ~USD 3,700 Bn and is expected to grow

at 5%-6% globally in the next five years.

Specialty Chemicals

The specialty chemicals market is characterized by high value-added, low volume

chemical production. These chemicals are used in a wide variety of products,

including fine chemicals, additives, advanced polymers, adhesives, sealants and

specialty paints, pigments, and coatings. The specialty market is extremely fragmented.

The consolidation of companies has been a major trend and is expected to

continue. Similar to the commodity sector, the specialty sector is affected by the high costs of energy and feedstock.

Growth Drivers across the Industries

The

COVID-19 pandemic has had an unprecedented impact on the global economy.

Chemical companies in North America

and Europe have specifically started focusing on operational efficiency, asset

optimization, and cost management. On a short-term basis, most companies are

considering implementing a series of targeted, strategic initiatives across

major functional areas such as R&D and technology.

Companies are also keen

on addressing long-term opportunities like investing in innovation, emerging

applications, adopting new business models that generate sustained growth,

analyzing temporary vs. permanent customer buying behavior patterns across geographies.

The industry is expected to see the following trends in the next 2-5 years -

• Companies

will try and shift their focus toward new value streams and growing end

markets, such as health care and electronics

• Most

governments have announced policy proposals related to regulation, trade, and

sustainability which could prove beneficial in shifting the dependence of the

industry from China

Growth from various Industries are as follows:

Owing to shutdowns in China and lack of capacity

additions in other developed countries, India stands to benefit in the export

market. Also supporting the growth in India is its ability to manufacture at a

lower price compared with its western counterparts. Moreover, the specialty

chemicals consumption in the country is low compared with the global average.

The increasing availability of basic chemicals is likely to support investments

in the specialty chemicals segment further.

The “Make in India” campaign is

also expected to add impetus to the emergence of India as a manufacturing hub for

the chemicals industry in the medium term. Through incentives, subsidies and

grants under this campaign, Indian companies could gain further ground as

companies would want to reduce dependence on China after the COVID-19 pandemic

and shift their supply chains.

The decline in raw materials prices could also

help the margins and reduce the working capital needs. However, input costs are a

pass-through for most companies and benefits could be limited. Overall, the chemicals industry is likely to continue to perform well in the near

to medium term and is expected to capitalize on the Make in India benefits to

assume a leadership position in the Global markets.

List of Chemical Companies:

Sources:

Indian Chemical sector - Presentation

Frost & Sullivan Indian Chemical Report

KPMG Report on Speciality Chemicals

PWC Speciality Chemicals

Avendus Speciality Chemical

IBEF

Twitter Handle: @shuchi_nahar

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links, references, and a compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

I’m Артур Борис a resident/citizen of the Republic Of Russian. I’m 42 years of age, an entrepreneur/businessman. I once had difficulties in financing my project/business, if not for a good friend of mine who introduced me to Mr Pedro to get a loan worth $250,000 USD from his company. When I contacted them it took just five working days to get my loan process done and transferred to my account. Even with a bad credit history, they still offer their service to you. They also offer all kinds of loans such as business loans, home loans, personal loans, car loans. I don’t know how to thank them for what they have done for me but God will reward them according to his riches in glory. If you need an urgent financial assistance contact them today via email pedroloanss@gmail.com

ReplyDelete