Laurus Labs - Result Update Q4FY21 & Full Year FY21

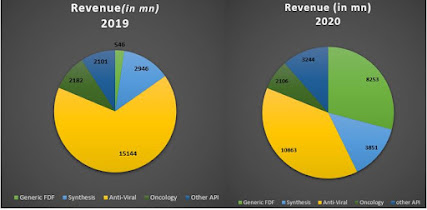

Laurus Labs - Result Update Q4FY21 & Full Year FY21 Twitter Handle: @shuchi_nahar Laurus Labs Limited on 30th April 2021 announced its Q4FY21 and full-year results. Laurus Lab performed extremely well consecutive in the 4th Quarter of FY21. The company did a robust growth in all three segments. Having a healthy order book for FY 22. Consolidated revenue for the quarter increased by 70% driven by growth in all the divisions. The company has been able to sustain its EBITDA margins, and profitability has also improved to Rs. 297 Crs. for the quarter. Generic API division showcased a robust growth of 61% YoY. Anti Viral segment recorded a robust growth of 70% YoY. Revenue Showcased a healthy growth of 102% YoY. The growth was led by higher LMIC Market volumes and increased volumes from North America and EU Commenced marketing of in-licensed products in the USA to leverage front-end capabilities. Custom Synthesis division recorded a strong growth of 35% YoY. Capacity Expansion – To