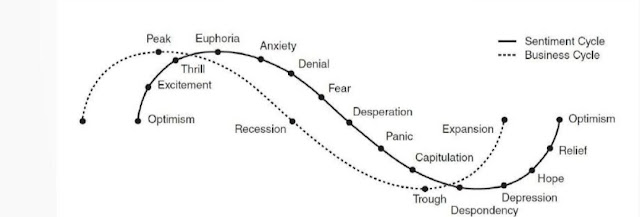

It's important to stay calm while Investing!

How to stay calm ,when markets are not? Shuchi.P.Nahar Introduction: The stock market volatility has radically increased in recent days and economies are currently passing through a tumultuous period has reflected in all financial markets and asset classes. The global economic slowdown created a lot of worries in the capital or equity and property market. Business organizations around the world have been affected by volatility in the stock and property markets. In India, fluctuations in the currency market can obstruct the stability in the equity market and hence stock market volatility shoots up. The study of volatility is therefore very important in an emerging market nation like India. Nifty volatility index is also called as India VIX which is treated as India’s volatility Index and is taken as an important indicator of market expectations of near-term volatility. Sometimes investing can feel like flying through a thunderstorm. Lots of bumps and noise. Hard