Recent Disruption in China, beneficial for Indian Chemical Companies

Recent disruption in China - Impact on Indian

Chemical Companies

Twitter Handle: @shuchi_nahar

Specialty Chemical Article: https://myweekendspot.blogspot.com/2021/07/speciality-chemicals-market-size-demand.html

Government scheme to boost: https://myweekendspot.blogspot.com/2021/07/government-initiatives-to-boost-growth.html

Indian specialty chemicals companies are

poised to ride tailwinds from macro drivers including ‘China+1’, import-substitution, growing costs within China (capital, operational, compliances), and currency benefits. Recent disruptions in China will cause medium-term challenges for downstream producers while benefiting base chemical suppliers. More importantly, these frequent supply disruptions in China further strengthen the case for quality Indian players in the chemical domain.

Growing import substitution by local industry makes a case for strengthening

volume growth for base chemical/intermediate suppliers. Recent disruptions in China (electricity

shortages, targeted plant closures) open another round of challenges for

already stretched chemical supply chains globally and in India. China seems to

be targeting companies/industries with higher energy consumption intensity and

polluting technologies. This is likely to drive volume shortages along with

significant price spikes for key raw materials.

Indian Specialty chemical

industry witnessed strong yoy demand and improved pricing scenario (led by

cost-push) in general during Q2. Such a scenario couple with the covid impacted

base of last year makes the revenue trend strong. India has a small 4% of the

global chemicals market that is growing at 5-6% in dollar terms. This suggests

that even a 15% CAGR in INR terms over the next 15 years would garner just an

8% global market share. This is modest given the expected and strategic

lowering of chemical exports by China (representing a 13-15% chunk of the

global market).

China’s chemical

industry has shifted its focus to self-sufficiency and high value-added

products

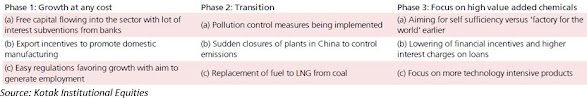

Three

phases of Chinese chemicals industry growthRecent developments further reiterate

China’s intent to not support capital inefficient and carbon inefficient

(whether energy or emissions) businesses. This is a departure from the policies

adopted over 2000-15. Cost structures would rise thanks to rising wages, energy

costs, appreciating currencies, and higher capital costs needed to meet

increased regulatory expectations. Indian players with proven chemistry skills,

world-class manufacturing, and the ability to build strong client engagements will

benefit.

Base chemicals to benefit in the near term

Commodities such as soda ash, caustic

soda, acetates, and PVC are already rallying on the back of these dual controls.

In most of these commodities, pricing is a function of import parity and

manufacturers of these commodities would benefit over the next 3-6 months.

Volume benefits may be limited as any capacity expansion to take advantage of

such shortages takes time, but price hikes would aid.

Over a longer period, China’s intent to

cut down exports of these energy-intensive industries augurs well for the

pricing environment in general. The challenges, however, would be the intent of

Indian companies to invest capital and demonstrate execution capabilities to do

these high-ticket projects and their competitiveness versus countries like

Malaysia, Thailand, and Vietnam, which may still have better infrastructure to

benefit from these capital-heavy projects (not chemistry-heavy unlike a few

specialty chemicals).

Indian chemicals players are expected to

benefit from higher commodity prices where China has dominance.

India’s chemicals market share would reach only 8.3% in 2035 despite 15% growth CAGR India market share projections assuming 5% global market growth in US$, 3% annual benefit, and 15% domestic industry growth share.

Source: Kotak Institutional Equities

What makes an Indian

specialty chemicals company scalable?

There are three lenses

through which investors should view this sector:

(1) Differentiation of process capabilities,

(2) Asset discipline (return on capital, return on carbon),

(3) Client engagement (trust, transparency).

Indian specialty chemical sector has grown

at 12%+ in the last five years and is well poised to expand its global market

share to 7-8% from 4% in the coming years. The structural drivers are in place

like global best practice manufacturing standard and R&D capability along

with government impetus of make in India policy with pro-growth policies will

act as a further catalyst for growth.

Sources: Kotak Research Report

Sherkhan research report

Nirmal Bang Report

Philip Capital Research Report

Twitter Handle: @shuchi_nahar

Disclaimer: The information provided on Shuchi Nahar’s Weekend Blog is for educational purposes only. The articles may contain external links, references, and a compilation of various publicly available articles. Hence all the authors are given due credit for the same. All copyrights and trademarks of images belong to their respective owners and are used for Fair Educational Purpose only.

Visit our website We are one of the leading Chemical Suppliers and Distributors in Delhi.

ReplyDeleteI jumped on an opportunity to purchase a rental property over the 4th of weekend. Mr Pedro was quick to respond and since this was my first time getting a loan to buy a rental property , he was able to help me walk through the loan process. It was a great experience working with a good and kind loan lender Mr Pedro. I hope you know very well if you are looking for a loan to purchase a property or funding business purposes then Mr PI jumped on an opportunity to purchase a rental property over the 4th of weekend. Mr Pedro was quick to respond and since this was my first time getting a loan to buy a rental property , he was able to help me walk through the loan process. It was a great experience working with a good and kind loan lender Mr Pedro. I hope you know very well if you are looking for a loan to purchase a property or funding business purposes then Mr Pedro will be able to help you with such a process here his details WhatsApp+1 863 231 0632 . / pedroloanss@gmail.com !” edro will be able to help you with such a process here his details WhatsApp+1 863 231 0632 . / pedroloanss@gmail.com !”

ReplyDelete