Tata Chemicals - Recent Updates

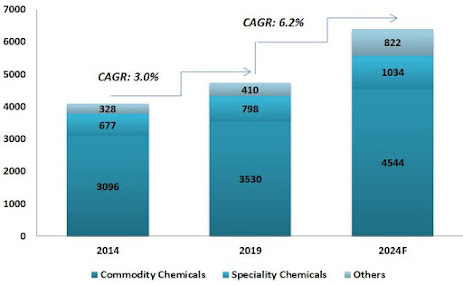

Tata Chemicals - https://myweekendspot.blogspot.com/2021/02/tata-chemicals-huge-opportunities-ahead.html Twitter Handle: @shuchi_nahar Recent updates about the company The chemical industry can play part in these sustainability solutions – reducing carbon emissions, turning waste into useful products, i.e. circular economy. Tata Chemicals can also play into chemicals going into health and hygiene – it already plays some bit through detergents and other applications of sodium bicarbonate. Grow volumes & maximize realizations in soda ash (price increased in Q2 FY22). Timely execution of capacity expansion: Salt 165k MT by end of FY22. Soda ash demand drivers Demand is likely to remain strong thanks to growing new applications in sustainability solutions. Soda ash demand is likely to pick up from the use of glass panels (flat glass) into solar cells, lithium carbonate (every ton needs one ton of soda ash), and the move to container glasses from plastics. This is likely to drive