CAPEX Acceleration in Indian Chemical Companies

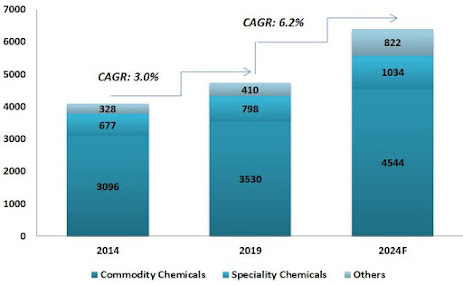

CAPEX Acceleration in Indian Chemical Companies - USD 300 bn domestic market by 2025 Twitter Handle: @shuchi_nahar India’s chemical industry was estimated to be worth USD 178 billion in FY 2019-20 and has a significant potential to reach USD 300 billion by FY 2024-25. In terms of demand, the industry has grown at approximately 1.3 times the country’s average GDP growth in the last five years and shows a strong linkage with its GDP. Indian specialty chemical sector has grown at 12%+ in the last five years and is well poised to expand its global market share to 7-8% from 4% in the coming years. The structural drivers are in place like global best practice manufacturing standard and R&D capability along with government impetus of make in India policy with pro-growth policies will act as a further catalyst for growth. Further, a global MNC looking at China Plus one strategy will help Indian incumbents to gain market share. In the short to medium term, supply disruptions emerging